Thuy bought a rental house in 2012 for $75,000. In 2020, she sells it for $86,000. Thuy

Question:

Thuy bought a rental house in 2012 for $75,000. In 2020, she sells it for $86,000. Thuy properly deducted $22,000 in depreciation on the house before its sale.

a. What is the amount and character of the gain on the sale?

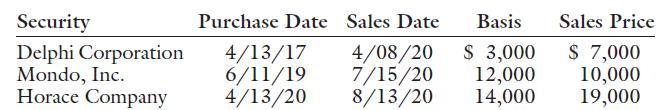

b. Thuy also sells the following securities:

Determine the amount of tax that Thuy will pay on her capital asset transactions. Assume that she is in the 35 percent marginal tax rate bracket.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2021

ISBN: 9780357141212

28th Edition

Authors: Kevin E. Murphy, Mark Higgins, Randy Skalberg

Question Posted: