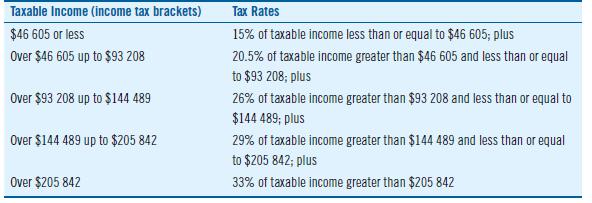

Use the 2018 federal income tax brackets and rates in Table 3.3 to answer the following question.

Question:

Use the 2018 federal income tax brackets and rates in Table 3.3 to answer the following question.

Victor calculated his 2018 taxable income to be $49 450. How much federal income tax should he report?

Table 3.3

Transcribed Image Text:

Taxable Income (income tax brackets) Tax Rates $46 605 or less 15% of taxable income less than or equal to $46 605; plus Over $46 605 up to $93 208 20.5% of taxable income greater than $46 605 and less than or equal to $93 208; plus Over $93 208 up to $144 489 26% of taxable income greater than $93 208 and less than or equal to $144 489; plus Over $144 489 up to $Z05 842 29% of taxable income greater than $144 489 and less than or equal to $205 842; plus Over $205 842 33% of taxable income greater than $205 842

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 28% (7 reviews)

To calculate the federal income tax that Victor should report for his 2018 taxa...View the full answer

Answered By

Nikka Ella Clavecillas Udaundo

I have a degree in psychology from Moi University, and I have experience working as a tutor for students in both psychology and other subjects. I am passionate about helping students learn and reach their potential, and I firmly believe that everyone has the ability to succeed if they receive the right support and guidance. I am patient and adaptable, and I will work with each individual student to tailor my teaching methods to their needs and learning style. I am confident in my ability to help students improve their grades and reach their academic goals, and I am excited to work with a new group of students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Contemporary Business Mathematics With Canadian Applications

ISBN: 9780135285015

12th Edition

Authors: Ali R. Hassanlou, S. A. Hummelbrunner, Kelly Halliday

Question Posted:

Students also viewed these Mathematics questions

-

Victor calculated his 2012 taxable income to be $49 450. How much federal income tax should he report? Use the 2012 federal income tax brackets and rates in Table 3.3 to answer the question.

-

Use information from Table 16.2 to answer the following questions about sound in air. At 20oC the bulk modulus for air is 1.42 X 105 Pa and its density is 1.20 kg/m3. At this temperature, what are...

-

Use the following payoff matrix to answer the following questions. Suppose this is a one-shot game:a. Determine the dominant strategy for each player. If such strategies do not exist, explain why...

-

Because the entries in the present value table (Table 13 - 3) are reciprocals of the corresponding entries in the future value table (Table 13 - 1), how can Table 13 - 3 be used to find the future...

-

How does acid mine drainage damage nearby streams and groundwater?

-

In this section we state that two lines, neither of which is vertical, are perpendicular if and only if their slopes have a product of -1. we outline a partial proof of this for the case where the...

-

A company is considering a new three-year expansion project that requires an initial fixed investment of \(\$ 1.8 \mathrm{MM}\). The fixed asset is depreciated based on the five-year class life in...

-

1. Are there any disagreements between or among the resulting orderings? If so, why do you think that is the case? 2. What can be done to mitigate any observed disagreement between or among the...

-

Direct labor or machine hours may not be the appropriate cost driver for overhead in all areas of manufacturing due to the complexities of many manufacturing processes. Many companies use...

-

The following labor hours data have been collected for a nanotechnology project for periods 1 through 6. Compute the SV, CV, SPI, and CPI for each period. Plot the EV and the AC on the summary graph...

-

Solve the following problem. Using 2015 as a base period, compute a simple price index for each of the following commodities. Interpret your results. Commodity Price in 2015 Price in 2017 Bread...

-

Set up ratios to compare each of the following sets of quantities. Reduce each ratio to its lowest terms. (a) Twenty-five dimes and three dollars (b) Tive hours to 50 min (c) $36.75 for thirty litres...

-

Let k,n be integers such that 0 k n and the binomial coefficient n!;(n - k)!k!, where 0! = 1 and for n > 0, n! = n(n - l)(n - 2) 2 l. (a) (b) (c) (d) is an integer. (e) if p is prime and 1 k P n...

-

If 5-x=4, then x =

-

How can open innovation frameworks such as crowdsourcing and hackathons be integrated into corporate R&D strategies to accelerate product development cycles and leverage external expertise ?

-

Selected data from the statement of cash flows of Park Corporation are as follows: Operating Activities Net cash provided by (used in) operating activities Investing Activities $ 46,000 Additions to...

-

Nadine, the Ranch Road Clinic's clinical service director, is organizing the addition of a new clinical service, an in-house pharmacy. She interacts with the finance team to learn about the costs,...

-

What is a fair price of a 28-year semi-annual coupon bond, with a coupon rate of 5.15%, a face value of $1000, and a yield-to-maturity of 9.81%? What is the yield?

-

Built-Tight is preparing its master budget for the quarter ended September 30, 2017. Budgeted sales and cash payments for product costs for the quarter follow: Sales are 20% cash and 80% on credit....

-

Consider the activities undertaken by a medical clinic in your area. Required 1. Do you consider a job order cost accounting system appropriate for the clinic? 2. Identify as many factors as possible...

-

Keys Company has targeted to build up a fund of $50 000. If $10 000 is deposited at the end of every six months, and the fund earns interest at 4% compounded quarterly, how long will it take to reach...

-

You are considering an investment in a technology company similar to Herjavec Group Inc. The new company, Newtech, has experienced impressive growth over the past five years, and further growth is...

-

How long will it take to save $15 000 by making deposits of $90 at the end of every month into an account earning interest at 4% compounded quarterly?

-

What is the balance in Work in Process Inventory at the end of each month? Work in Process Inventory April 30 $ May 31 A 10,140 15,950 June 30 $ 10,450

-

Sako Company s Audio Division produces a speaker used by manufacturers of various audio products. Sales and cost data on the speaker follow: Selling price per unit on the intermediate market $ 6 0...

-

Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses...

Study smarter with the SolutionInn App