Jay Olsen. a writer of novels, just has completed a new thriller novel. A movie company and

Question:

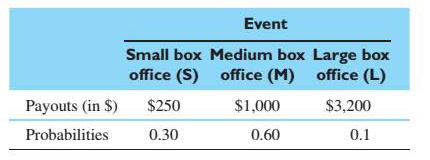

Jay Olsen. a writer of novels, just has completed a new thriller novel. A movie company and a TV network both want exclusive rights to market his new title, if he signs with the network, he will receive a single lump sum of $900. hut if he signs with the movie company. the amount he will receive depends on how successful the movie is at the box office. (All $ units are in thousands.)

• TV Network: $900

• Movie

(a) Which option would you recommend based on the expected monetary value (EMV) criterion? (Assume that he is a risk-neutral person interested in maximizing the expected monetary value.)

(b) How much would he be willing to pay to know the true state of nature?

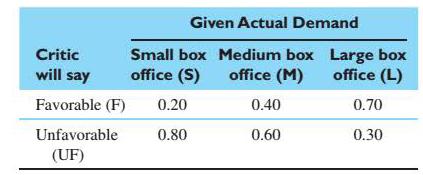

(c) Jay can send his novel to a prominent movie critic to assess the potential box office success. From his past experience, the movie critic’s reliability of predicting the box office success is as follows. Favorable prediction means that it is highly likely the movie would be a box office success. It will cost $20 to get his novel evaluated by the movie critic.

For example. when the true state of nature is ‘S.” the movie critic will say “F with a 20% probability. Determine Jays strategy that maximizes the expected payoff after receiving the movie critic’s report. In doing so, compute the EVPI after taking the survey. What is the true worth of the market survey?

Step by Step Answer: