4. Suppose there are three possible assets from which the North American Bank can choose two to...

Question:

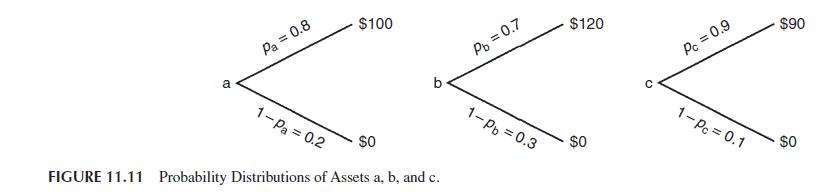

4. Suppose there are three possible assets from which the North American Bank can choose two to securitize. Call these assets a, b, and c. The assets are quite similar and their cash-flow distributions are as described below. The probability of “success” for asset i is p i . Compute the probability distributions of the various portfolio combinations. How important would it be for an investor to know precisely which two assets were in the securitized portfolio? Would your answer change if asset c were replaced by asset d, which has a cash flow that is uniformly distributed over [0, 1000].

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Contemporary Financial Intermediation

ISBN: 9780124052086

4th Edition

Authors: Stuart I. Greenbaum, Anjan V. Thakor, Arnoud Boot

Question Posted: