Suppose that you are the loan officer for the Midtown Community Bank and you know that within

Question:

Suppose that you are the loan officer for the Midtown Community Bank and you know that within a particular risk class, there are two types of borrowers: low-risk borrowers and high-risk borrowers. However, you cannot distinguish between them.

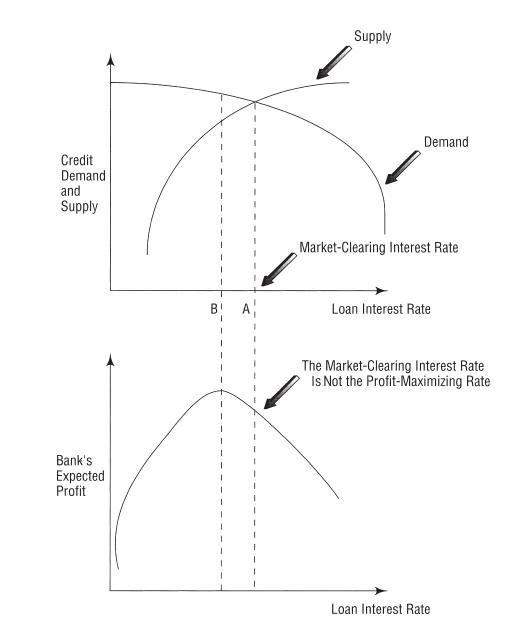

You believe that the probability that a randomly chosen borrower is low risk is 0.5 and that the borrower is high risk is 0.5. There are 1000 potential loan applications of each type within this risk class. Each applicant would like a loan of $100. The low-risk borrower will invest this loan in a project that lasts for one period hence will yield $130 with probability 0.9 and nothing with probability 0.1. The high-risk borrower will invest the loan in a project that will yield $135 with probability 0.8 and nothing with probability 0.2 one period hence. Midtown Community Bank is a monopolist with respect to these borrowers. 9 Assuming that the only pricing instrument available is the loan interest rate, how should you price a loan to a borrower in this risk class so as to maximize the bank’s expected profit? You have only $100,000 available to lend and the junior lending officer who reports to you has advised you that 2000 loan applications were received when it was announced that the bank would charge an interest rate of 29%. The current riskless rate is 5%. Assume that a borrower must have at least 1 dollar of net profit in the successful state in order to apply for a bank loan, 10 and that there is universal risk neutrality.

Step by Step Answer:

Contemporary Financial Intermediation

ISBN: 9780124052086

4th Edition

Authors: Stuart I. Greenbaum, Anjan V. Thakor, Arnoud Boot