Walsh Company is considering three independent projects, each of which requires a $4 million investment. The estimated

Question:

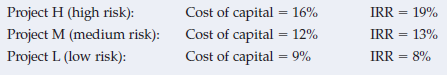

Walsh Company is considering three independent projects, each of which requires a $4 million investment. The estimated internal rate of return (IRR) and cost of capital for these projects are presented here:

Note that the projects? costs of capital vary because the projects have different levels of risk. The company?s optimal capital structure calls for 40% debt and 60% common equity, and it expects to have net income of $7,500,000. If Walsh establishes its dividends from the residual dividend model, what will be its payout ratio?

Internal Rate of ReturnInternal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Capital Structure

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: