S. Nigam decided to covert his business into a limited company as and from 1st April, 2016,

Question:

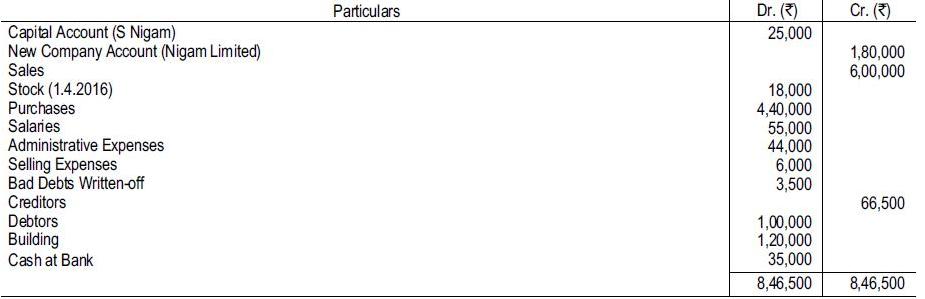

S. Nigam decided to covert his business into a limited company as and from 1st April, 2016, and decided to become a director on a monthly salary of ₹ 1,000. The company was duly incorporated on 1st May, 2016 under the name of M/s Nigam Limited and received a commencement certificate on 1st June, 2016. On 1st May, 2016, 18,000 equity shares of ₹ 10 each were issued for cash and S Nigam retained 2,000 equity shares as part consideration. Out of proceeds of the issue, S Nigam was paid ₹ 1,40,000 as the balance of the purchase price and ₹ 15,000 for expenses incurred by him in connection with the formation of the company. S Nigam continued same set of books and accounts. The Trial Balance, before adjustment, at 31st March, 2017 is as follows: Shri Nigam has not been credited with salary to date nor has he received anything on account. the stock at 31st March, 2017 is valued at ₹8,000. A revaluation on 1st April, 2016 showed that the building was worth ₹1,30,000 and that ₹5,000 of debts were doubtful or bad. Against the latter it was agreed to provide ₹4,000. Actually only debts to the value of ₹2,000 have proved to be bad, the balance having been collected by the company. Capital of Shri Nigam on 1st April, 2016 was ₹1,30,000. Prepare Balance Sheet of M/s Nigam Limited as at 31st March, 2017 with relative Profit and Loss Account to the date, giving effect to the adjustments necessary, but yet unrecorded, on account of the change of ownership.

Shri Nigam has not been credited with salary to date nor has he received anything on account. the stock at 31st March, 2017 is valued at ₹8,000. A revaluation on 1st April, 2016 showed that the building was worth ₹1,30,000 and that ₹5,000 of debts were doubtful or bad. Against the latter it was agreed to provide ₹4,000. Actually only debts to the value of ₹2,000 have proved to be bad, the balance having been collected by the company. Capital of Shri Nigam on 1st April, 2016 was ₹1,30,000. Prepare Balance Sheet of M/s Nigam Limited as at 31st March, 2017 with relative Profit and Loss Account to the date, giving effect to the adjustments necessary, but yet unrecorded, on account of the change of ownership.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee