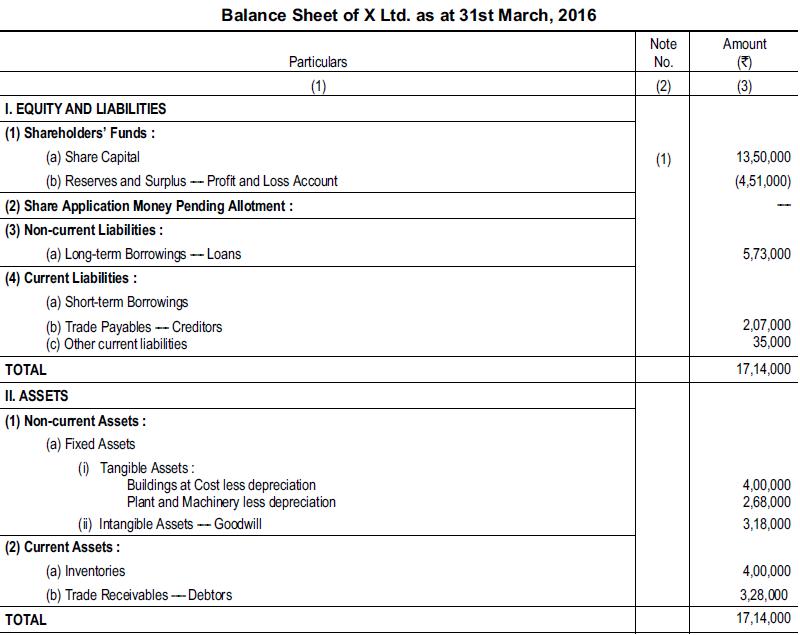

The Balance Sheet of X Ltd. before reconstruction is as follows: Preference dividend is in arrear for

Question:

The Balance Sheet of X Ltd. before reconstruction is as follows:

Preference dividend is in arrear for five years. The company is now earning profits but is short of working capital. A reconstruction scheme has, therefore, been approved which is as follows:

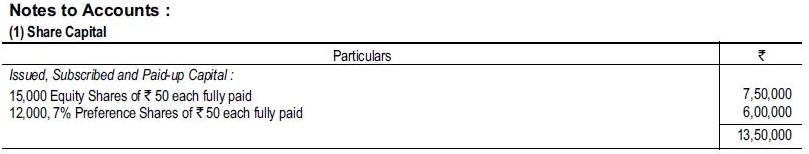

(1) Equity shareholders have agreed that their ₹ 50 shares be reduced to ₹ 2.50 per share and they have agreed to subscribe in cash for 3 equity shares of ₹ 2.50 each for every equity share held.

(2) Preference shareholders have agreed to cancel the arrears of preference dividend and to accept for each ₹ 50 preference share, 4 new 5% preference shares of ₹ 10 each plus 6 new equity shares of ₹ 2.50 each, all credited as fully paid.

(3) Lenders to the company of ₹ 1,50,000 have agreed to convert their loan into shares and, for their purpose, they will be allotted 12,000 new 5% preference shares of ₹ 10 each and 12,000 new equity shares of ₹ 2.50 each, are credited as fully paid.

(4) The directors have agreed to subscribe in cash for 40,000 new equity shares of ₹ 2.50 each in addition to any shares to be subscribed for by them under (1) above.

(5) Of the cash received, ₹ 2,00,000 is to be used to reduce loans due by the company.

(6) Authorised capital is to be increased to the old figure of ₹ 6,00,000 for preference capital and ₹ 7,50,000 for equity capital.

(7) The equity share capital cancelled is to be applied to write-off debit balance on Profit and Loss Account, to reduce ₹ 35,000 from the value of plant and any balance remaining to be used to write-down the value of goodwill. Pass journal entries and re-draft the Balance Sheet.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee