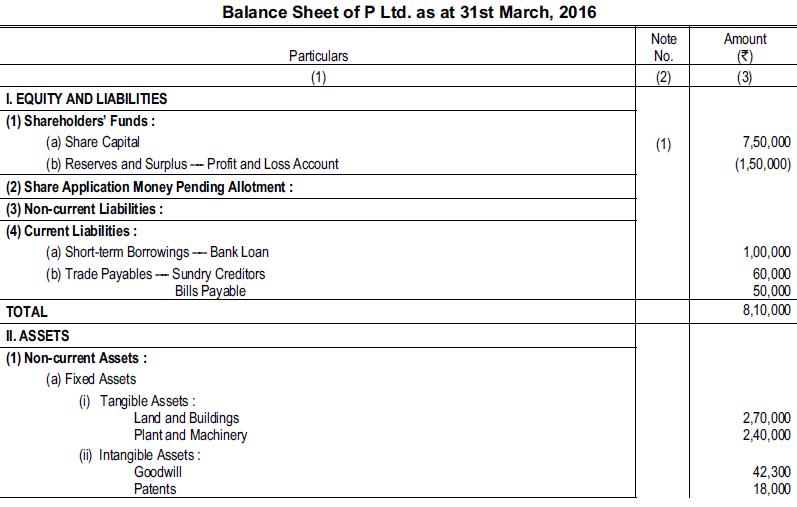

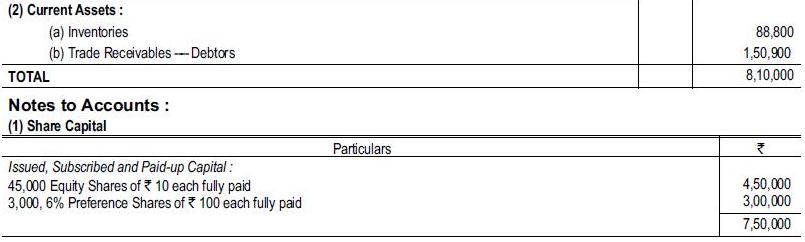

The Balance Sheet of P Ltd., as on 31st March, 2016 is as stated below: Dividends on

Question:

The Balance Sheet of P Ltd., as on 31st March, 2016 is as stated below:

Dividends on preference shares are in arrear for three years. The company passes a Special Resolution to reduce its capital in accordance with the following scheme and the same is duly sanctioned by the Tribunal :

Dividends on preference shares are in arrear for three years. The company passes a Special Resolution to reduce its capital in accordance with the following scheme and the same is duly sanctioned by the Tribunal :

(a) The Preference Shares are converted from 6% to 8%, but revalued in a manner in which the total return on them remains unaffected. The value of Equity Shares is brought down to ₹ 8 per share.

(b) The arrears of dividend on Preference Shares are cancelled.

(c) The debit balance of the Goodwill Account is written-off entirely.

(d) Land and Building and Plant and Machinery are revalued at 85% and 80% of their respective book values.

(e) Book debts to the amount of ₹ 7,200 are treated as bad and hence, to be written-off.

(f) The company expects to earn profit @ ₹ 45,000 per annum from the current year which would be utilised entirely for reducing the debit balance of the Profit and Loss Account for three years. The remaining balance of the said account would be written-off at the time of capital reduction process.

(g) The balance of total capital reduction is to be utilised in writing-down patents.

(h) A secured loan of ₹ 2,40,000 bearing interest at 12% p.a. is to be obtained by mortgaging tangible fixed assets for procuring cash for repayment of bank overdraft and for providing additional funds for working capital. Journalise the above scheme and draw a Balance Sheet after the implementation is over.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee