Consider the setting of Problem 18. You decided to look for other comparables to reduce estimation error

Question:

Consider the setting of Problem 18. You decided to look for other comparables to reduce estimation error in your cost of capital estimate. You find a second firm, Thurbinar Design, which is also engaged in a similar line of business. Thurbinar has a stock price of $16 per share, with 16 million shares outstanding. It also has $110 million in outstanding debt, with a yield on the debt of 4.1 %. Thurbinar's equity beta is 1.00.

a. Assume Thurbinar’s debt has a beta of zero. Estimate Thurbinar’s unlevered beta. Use the unlevered beta and the CAPM to estimate Thurbinar’s unlevered cost of capital.

b. Estimate Thurbinar’s equity cost of capital using the CAPM. Then assume its debt cost of capital equals its yield, and using these results, estimate Thurbinar’s unlevered cost of capital.

c. Explain the difference between your estimates in part (a) and part (b).

d. You decide to average your results in part (a) and part (b), and then average this result with your estimate from Problem 17. What is your estimate for the cost of capital of your firm’s project?

Problem 18

Your firm is planning to invest in an automated packaging plant. Harburtin Industries is an all-equity firm that specializes in this business. Suppose Harburtin’s equity beta is 0.88, the risk-free rate is 3.9%, and the market risk premium is 4.9%. If your firm’s project is all equity financed, estimate its cost of capital.

Problem 17

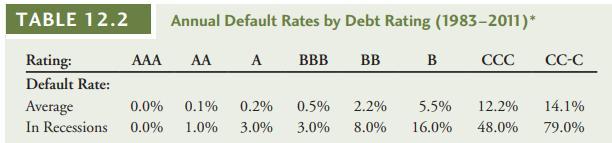

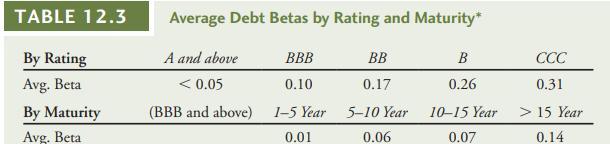

The Dunley Corp. plans to issue 5-year bonds. It believes the bonds will have a BBB rating. Suppose AAA bonds with the same maturity have a 4% yield. Assume the market risk premium is 5% and use the data in Table 12.2 and Table 12.3.

Table 12.2

Table 12.3

Step by Step Answer:

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo