DFS Corporation is currently an all-equity firm, with assets with a market value of $155 million and

Question:

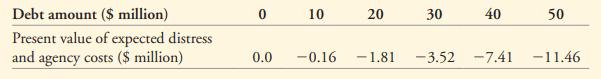

DFS Corporation is currently an all-equity firm, with assets with a market value of $155 million and 4 million shares outstanding. DFS is considering a leveraged recapitalization to boost its share price. The firm plans to raise a fixed amount of permanent debt (i.e., the outstanding principal will remain constant) and use the proceeds to repurchase shares. DFS pays a 25% corporate tax rate, so one motivation for taking on the debt is to reduce the firm’s tax liability. However, the upfront investment banking fees associated with the recapitalization will be 1% of the amount of debt raised. Adding leverage will also create the possibility of future financial distress or agency costs; shown below are DFS’s estimates for different levels of debt:

a. Based on this information, which level of debt shown above is the best choice for DFS?

b. Estimate the stock price once this transaction is announced.

Step by Step Answer:

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo