1. East Coast Yachts uses a small percentage of preferred stock as a source of financing. In...

Question:

1. East Coast Yachts uses a small percentage of preferred stock as a source of financing. In calculating the ratios for the company, should preferred stock be included as part of the company’s total equity?

2. Calculate all of the ratios listed in the industry table for East Coast Yachts.

3. Compare the performance of East Coast Yachts to the industry as a whole. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How would you interpret this ratio? How does East Coast Yachts compare to the industry average for this ratio?

4. Calculate the sustainable growth rate for East Coast Yachts. Calculate external funds needed (EFN) and prepare pro forma income statements and balance sheets assuming growth at precisely this rate. Recalculate the ratios in the previous question. What do you observe?

5. As a practical matter, East Coast Yachts is unlikely to be willing to raise external equity capital, in part because the shareholders don’t want to dilute their existing ownership and control positions. However, East Coast Yachts is planning for a growth rate of 20 percent next year. What are your conclusions and recommendations about the feasibility of East Coast’s expansion plans?

6. Most assets can be increased as a percentage of sales. For instance, cash can be increased by any amount. However, fixed assets often must be increased in specific amounts because it is impossible, as a practical matter, to buy part of a new plant or machine. In this case, a company has a “staircase” or “lumpy” fixed cost structure. Assume that East Coast Yachts is currently producing at 100 percent of capacity and sales are expected to grow at 20 percent. As a result, to expand production, the company must set up an entirely new line at a cost of $95,000,000. Prepare the pro forma income statement and balance sheet. What is the new EFN with these assumptions? What does this imply about capacity utilization for East Coast Yachts next year?

After Dan’s analysis of East Coast Yachts’s cash flow (at the end of our previous chapter), Larissa approached Dan about the company’s performance and future growth plans. First, Larissa wants to find out how East Coast Yachts is performing relative to its peers. Additionally, she wants to find out the future financing necessary to fund the company’s growth. In the past, East Coast Yachts experienced difficulty in financing its growth plan, in large part because of poor planning. In fact, the company had to turn down several large jobs because its facilities were unable to handle the additional demand. Larissa hoped that Dan would be able to estimate the amount of capital the company would have to raise next year so that East Coast Yachts would be better prepared to fund its expansion plans.

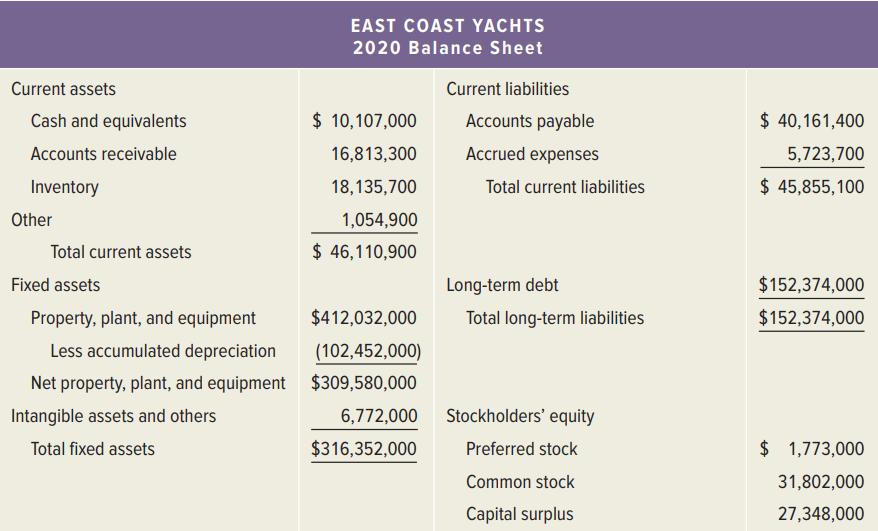

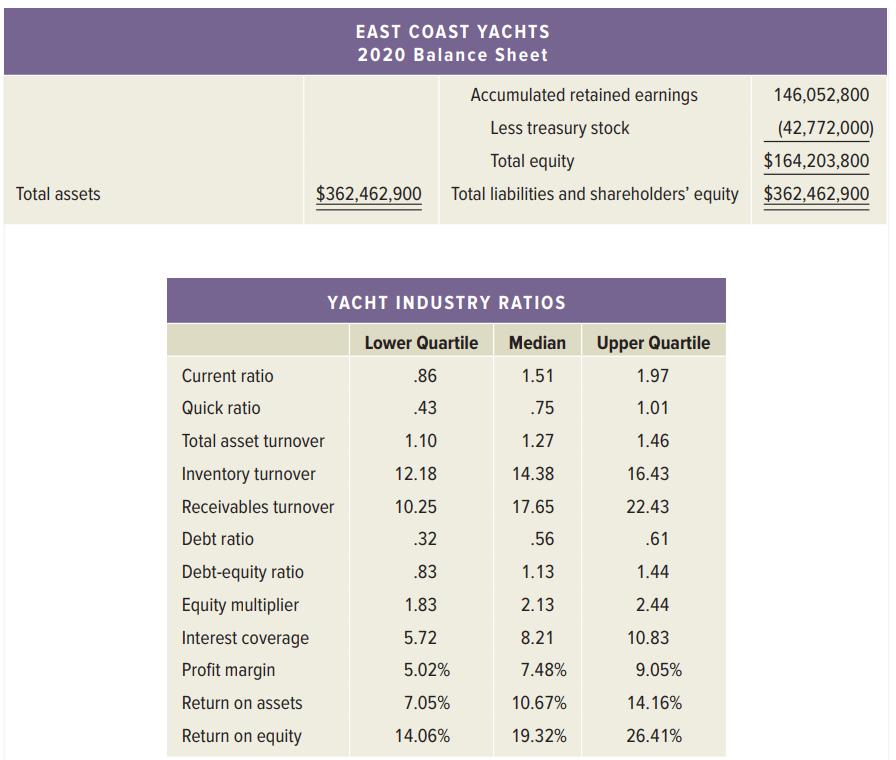

To get Dan started with his analyses, Larissa provided the following financial statements. Dan then gathered the industry ratios for the yacht manufacturing industry.

EAST COAST YACHTS

2020 Income Statement

Sales ..........................................................$550,424,000

Cost of goods sold .....................................397,185,000

Selling, general, and administrative ..........65,778,000

Depreciation ..............................................17,963,000

EBIT ............................................................$ 69,498,000

Interest expense .......................................9,900,000

EBT ............................................................$ 59,598,000

Taxes (25%) ..............................................14,899,500

Net income ..............................................$ 44,698,500

Dividends .................................................$ 19,374,500

Retained earnings ......................................25,324,000

Step by Step Answer:

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan