Consider the following information on three stocks: a. If your portfolio is invested 25 percent each in

Question:

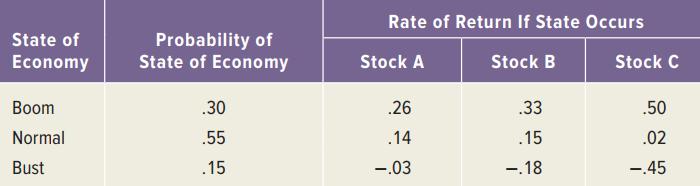

Consider the following information on three stocks:

a. If your portfolio is invested 25 percent each in A and B and 50 percent in C, what is the portfolio expected return? The variance? The standard deviation?

b. If the expected T-bill rate is 4.10 percent, what is the expected risk premium on the portfolio?

c. If the expected inflation rate is 3.50 percent, what are the approximate and exact expected real returns on the portfolio? What are the approximate and exact expected real risk premiums on the portfolio?

Rate of Return If State Occurs Probability of State of Economy State of Economy Stock A Stock B Stock C Boom .30 .26 .33 .50 Normal .55 .14 .15 .02 Bust .15 -.03 -.18 -45

Step by Step Answer:

a We need to find the return of the portfolio in each state of the economy To do this we will multiply the return of each asset by its portfolio weigh...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Consider the following information: a. Your portfolio is invested 25 percent each in A and C and 50 percent in B. What is the expected return of the portfolio? b. What is the variance of this...

-

Consider the following information: a. Your portfolio is invested 25 percent each in A and C and 50 percent in B. What is the expected return of the portfolio? b. What is the variance of this...

-

Consider the following information on the stock market in a small economy. a. Compute a price-weighted stock price index for the beginning of the year and the end of the year. What is the percentage...

-

1. If a firm has already paid an expense or is obligated to pay one in the future, regardless of whether a particular project is undertaken, that expense is a A. Committed cost B. Complementary cost...

-

In Fig. 12-6, the differences between the x86 and the UltraSPARC are hidden by conditional compilation. Could the same approach be used to hide the difference between x86 machines with an IDE disk as...

-

Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activities during March 2020: Required Prepare journal entries to record the transactions. Invested $50,000...

-

List the steps of data wrangling and explain what is done in each step.

-

A partial adjusted trial balance of Manumaleuna Company at January 31, 2012, shows the following. InstructionsAnswer the following questions, assuming the year begins January 1.(a) If the amount in...

-

2 m Silt 6 m 3 m Clay A 5 m 2 m Sand under artesian pressure Bedrock Soil profile is given in Figure. The ground water level is 2 m below the ground surface. The sand layer below the clay is under...

-

Locate an example of professional communication in any medium-channel that you think would work equally well-or perhaps better-in another medium. Using the information in this chapter and your...

-

You want to create a portfolio equally as risky as the market, and you have $1 million to invest. Given this information, fill in the rest of the following table: Asset Investment Beta Stock A...

-

A stock has a beta of 1.13 and an expected return of 11.8 percent. A risk-free asset currently earns 2.6 percent. a. What is the expected return on a portfolio that is equally invested in the two...

-

The following additional information is available for the Albert and Allison Gaytor family. The Gaytors own a rental beach house in Hawaii. The beach house was rented for the full year during 2018...

-

A Draw up a bank reconciliation statement, after writing the cash book up to date, ascertaining the balance on the bank statement, from the following as on 31 March 2012: Cash at bank as per bank...

-

Why is the distinction between classifying something as capital expenditure and classifying it as revenue expenditure so important to the users of financial statements?

-

From Nymans arguments, do all increased expenditures become welfare enhancing? Give examples of some that enhance welfare. Give examples of others that do not.

-

A Black and Blue Ltd depreciates its forklift trucks using a reducing balance rate of 30 per cent. Its accounting year end is 30 September. On 30 September 2013, it owned four forklift trucks: (A)...

-

Explain whether there is any difference between goals in maximizing output for a given cost or minimizing the cost of producing a given level of output.

-

On January 1, Pop Corporation pays $400,000 cash and also issues 36,000 shares of $10 par common stock with a market value of $660,000 for all the outstanding common shares of Son Corporation. In...

-

This problem continues the Draper Consulting, Inc., situation from Problem 12-45 of Chapter 12. In October, Draper has the following transactions related to its common shares: Oct 1 Draper...

-

Klingon Cruisers, Inc., purchased new cloaking machinery three years ago for $7 million. The machinery can be sold to the Romulans today for $5.3 million. Klingons current balance sheet shows net...

-

The Alexander Co. had $328,500 in taxable income. Using the rates from Table 2.3 in the chapter, calculate the companys income taxes. What is the average tax rate? What is the marginal tax rate? Data...

-

Timsung, Inc., has sales of $30,700, costs of $11,100, depreciation expense of $2,100, and interest expense of $1,140. If the tax rate is 40 percent, what is the operating cash flow, or OCF?

-

What is the yield to maturity of a 23-year bond that pays a coupon rate of 8.25% per year, has a $1,000 par value , and is currently priced at $1,298.05?

-

Suppose the exchange rate between U.S. dollars and Swiss francs is SF 1.112 = $1.00, and the exchange rate between the U.S. dollar and the euro is $1.00 = 0.9842 euros. What is the cross-rate of...

-

Use the following information for the Lowell, Inc. for this and the next two questions. Sales $200,000 Debt 95,000 Dividends 5,000 Equity 40,000 Net income 16,000 1.What is the company's...

Study smarter with the SolutionInn App