Suppose your company imports computer motherboards from Singapore. The exchange rate is given in Figure 20.1. You

Question:

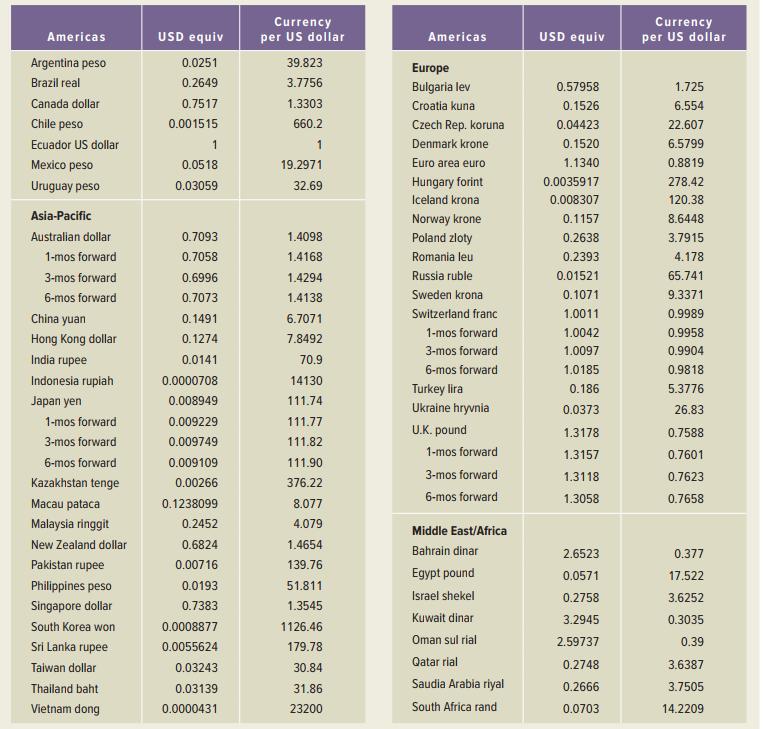

Suppose your company imports computer motherboards from Singapore. The exchange rate is given in Figure 20.1. You have just placed an order for 30,000 motherboards at a cost to you of 124.60 Singapore dollars each. You will pay for the shipment when it arrives in 90 days. You can sell the motherboards for $98 each. Calculate your profit if the exchange rate goes up or down by 10 percent over the next 90 days. What is the break-even exchange rate? What percentage rise or fall does this represent in terms of the Singapore dollar versus the U.S. dollar?

Transcribed Image Text:

Currency USD equiv per US dollar USD equiv Currency per US dollar Americas Americas Argentina peso 0.0251 39.823 Europe Brazil real 0.2649 3.7756 Bulgaria lev 0.57958 1.725 Canada dollar 0.7517 1.3303 Croatia kuna 0.1526 6.554 Chile peso 0.001515 660.2 Czech Rep. koruna 0.04423 22.607 Ecuador US dollar 1 1 Denmark krone 0.1520 6.5799 Mexico peso 0.0518 19.2971 Euro area euro 1.1340 0.8819 Uruguay peso Hungary forint 0.0035917 278.42 0.03059 32.69 Iceland krona 0.008307 120.38 Asia-Pacific Norway krone 0.1157 8.6448 Australian dollar 0.7093 1.4098 Poland zloty 0.2638 3.7915 1-mos forward 0.7058 1.4168 Romania leu 0.2393 4.178 3-mos forward 0.6996 1.4294 Russia ruble 0.01521 65.741 6-mos forward 0.7073 1.4138 Sweden krona 0.1071 9.3371 Switzerland franc 1.0011 0.9989 China yuan 0.1491 6.7071 1-mos forward 1.0042 0.9958 Hong Kong dollar 0.1274 7.8492 3-mos forward 1.0097 0.9904 India rupee 0.0141 70.9 6-mos forward 1.0185 0.9818 Indonesia rupiah 0.0000708 14130 Turkey lira Ukraine hryvnia 0.186 5.3776 Japan yen 0.008949 111.74 0.0373 26.83 1-mos forward 0.009229 111.77 U.K. pound 1.3178 0.7588 3-mos forward 0.009749 111.82 1-mos forward 1.3157 0.7601 6-mos forward 0.009109 111.90 3-mos forward 1.3118 0.7623 Kazakhstan tenge 0.00266 376.22 6-mos forward 1.3058 0.7658 Macau pataca 0.1238099 8.077 Malaysia ringgit 0.2452 4.079 Middle East/Africa New Zealand dollar 0.6824 1.4654 Bahrain dinar 2.6523 0.377 Pakistan rupee 0.00716 139.76 Egypt pound 0.0571 17.522 Philippines peso 0.0193 51.811 Israel shekel 0.2758 3.6252 Singapore dollar 0.7383 1.3545 Kuwait dinar 3.2945 0.3035 Suth Korea won 0.0008877 1126.46 Oman sul rial 2.59737 0.39 Sri Lanka rupee 0.0055624 179.78 Taiwan dollar 0.03243 30.84 Qatar rial 0.2748 3.6387 Thailand baht 0.03139 31.86 Saudia Arabia riyal 0.2666 3.7505 Vietnam dong 0.0000431 23200 South Africa rand 0.0703 14.2209

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 76% (13 reviews)

The profit will be the quantity sold times the sales price minus the cost of production T...View the full answer

Answered By

Hemstone Ouma

"Hi there! My name is Hemstone Ouma and I am a computer scientist with a strong background in hands-on experience skills such as programming, sofware development and testing to name just a few. I have a degree in computer science from Dedan Kimathi University of Technology and a Masters degree from the University of Nairobi in Business Education. I have spent the past 6 years working in the field, gaining a wide range of skills and knowledge. In my current role as a programmer, I have had the opportunity to work on a variety of projects and have developed a strong understanding of several programming languages such as python, java, C++, C# and Javascript.

In addition to my professional experience, I also have a passion for teaching and helping others to learn. I have experience as a tutor, both in a formal setting and on a one-on-one basis, and have a proven track record of helping students to succeed. I believe that with the right guidance and support, anyone can learn and excel in computer science.

I am excited to bring my skills and experience to a new opportunity and am always looking for ways to make an impact and grow as a professional. I am confident that my hands-on experience as a computer scientist and tutor make me a strong candidate for any role and I am excited to see where my career will take me next.

5.00+

8+ Reviews

22+ Question Solved

Related Book For

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

A large mail-order company has placed an order for 5,000 thermal-powered fans to sit on wood-burning stoves from a supplier in Canada, with the stipulation that no more than 2% of the units will be...

-

An office manager placed an order for computers, printers, and scanners. Each computer cost $1000, each printer cost $100, and each scanner cost $400. She ordered 15 items for $10,200. Give two...

-

A company produces items at a cost to them of 110E per item. On top of that, there are fixed costs of 700,000E. The expected number of sales is modeled using the function 70,000 - 200p where p Euro...

-

What are the side effects of the drugs that are used for treatment of Multiple Sclerosis attacks? Are cataracts a result of steroid use? Is osteoporosis a complication of Multiple Sclerosis?

-

The data in the next table, compiled by the Center for International Trade Development (CITD), provide a listing of the top 30 U.S. export markets for sparkling wines. Descriptive statistics for the...

-

Connor Ward wishes to have $800,000 in a retirement fund 20 years from now. He can create the retirement fund by making a single lump-sum deposit today. a. If he can earn 6 percent on his...

-

Discuss the criminal trial process.

-

Martinez Manufacturing Inc. showed the following costs for last month: Direct materials ....... $7,000 Direct labor ......... 3,000 Manufacturing overhead ... 2,000 Selling expense ........ 8,000...

-

Responding to activities that are regarded as computer crimes requires specific activities to be carried out from beginning to end. A. Name ANY TWO (2) positions for members included in an incident...

-

In free space, V = 6xy2z + 8. At point P(1, 2, 5) , find E and v.

-

Suppose the spot and six-month forward rates on the Norwegian krone are Kr 8.53 and Kr 8.61, respectively. The annual risk-free rate in the United States is 3.2 percent, and the annual risk-free rate...

-

The treasurer of a major U.S. firm has $30 million to invest for three months. The interest rate in the United States is .39 percent per month. The interest rate in Great Britain is .41 percent per...

-

The members of a population are numbered 14. a. List the 6 possible samples (without replacement) of size 2 from this population. b. If an SRS of size 2 is taken from the population, what are the...

-

discuss what a trend of debt to equity and quick ratios will tell that a single ratio cannot.

-

to calculate your companys potential demand for round 1 in each market segment you should divide each product segments total demand by what number?

-

The relevant range for Maxco Industries is 10,000 to 16,000 units of product. The variable costs per unit are $5.5 when a company produces 11,000 units of product. What are the varialive costs per...

-

Under the insurance contractual provision of Coinsurance for property coverage, calculate the amount that the insurance company would pay in the following case (no deductible applies). Building has...

-

Fidelak Corp. has a mine ( non - oil / gas ) expected to produce 2 , 8 0 0 units. Fidelak paid $ 1 4 0 , 0 0 0 for the mine. This year Fidelak will obtain 1 0 0 units from the mine. The applicable...

-

The following accounts and corresponding balances were drawn from Delsey Company's 2017 and 2016 year-end balance sheets: Account...

-

Drainee purchases direct materials each month. Its payment history shows that 65% is paid in the month of purchase with the remaining balance paid the month after purchase. Prepare a cash payment...

-

RightPrice Investors, Inc., is considering the purchase of a $415,000 computer with an economic life of five years. The computer will be fully depreciated over five years using the straight-line...

-

A firm is considering an investment in a new machine with a price of $15.6 million to replace its existing machine. The current machine has a book value of $5.4 million and a market value of $4.1...

-

Sanders Enterprises, Inc., has been considering the purchase of a new manufacturing facility for $750,000. The facility is to be fully depreciated on a straight-line basis over seven years. It is...

-

Find the integrating factor for the given 1-order linear non-homogeneous ordinary differential equation. Do not solve the ordinary differential equation. y xdx-xdy-x+dx + dx

-

[Bush] Consider the following snippet of code. (Assume that input strings, including null terminator, will always fit within the size 255 array.) char* to_upper_case(char* original) { char...

-

50. Show that if f(x) = a,x" + a-1x+...+x+ ao, a,..., a-1, and a,, are real numbers and where 0, then f(x) is O(x"). an # Big-O, big-Theta, and big-Omega notation can be extended to functions in more...

Study smarter with the SolutionInn App