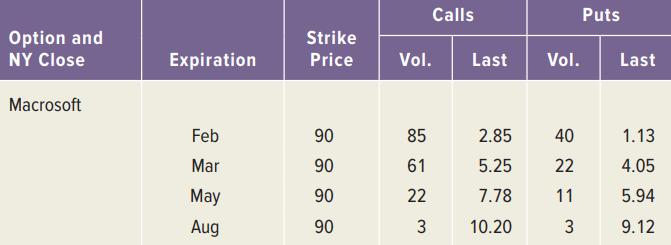

Use the option quote information shown below to answer the questions that follow. The stock is currently

Question:

Use the option quote information shown below to answer the questions that follow. The stock is currently selling for $93.

a. Suppose you buy 10 contracts of the February 90 call option. How much will you pay, ignoring commissions?

b. In part (a), suppose that Macrosoft stock is selling for $96 per share on the expiration date. How much is your options’ investment worth? What if the terminal stock price is $107? Explain.

c. Suppose you buy 10 contracts of the August 90 put option. What is your maximum gain? On the expiration date, Macrosoft is selling for $83 per share. How much is your options’ investment worth? What is your net gain?

d. In part (c), suppose you sell 10 of the August 90 put contracts. What is your net gain or loss if Macrosoft is selling for $88 at expiration? For $98? What is the break-even price, that is, the terminal stock price that results in a zero profit?

Step by Step Answer:

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan