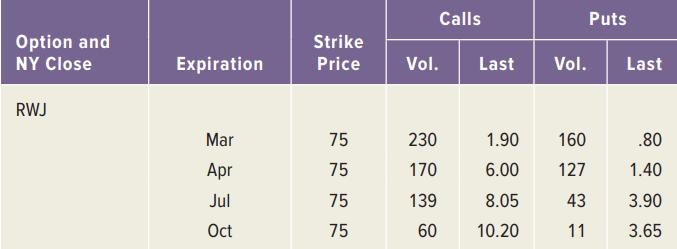

Use the option quote information shown here to answer the questions that follow. The stock is currently

Question:

Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $77.

a. Are the call options in the money? What is the intrinsic value of an RWJ Corp. call option?

b. Are the put options in the money? What is the intrinsic value of an RWJ Corp. put option?

c. Two of the options are clearly mispriced. Which ones? At a minimum, what should the mispriced options sell for? Explain how you could profit from the mispricing in each case.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted: