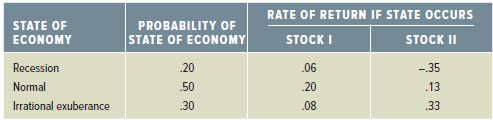

Consider the following information on Stocks I and II: The market risk premium is 7.5 percent, and

Question:

The market risk premium is 7.5 percent, and the risk-free rate is 3 percent. Which stock has the most systematic risk? Which one has the most unsystematic risk? Which stock is €œriskier€? Explain.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted: