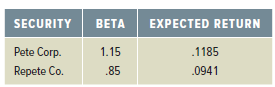

Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what

Question:

Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate?

Transcribed Image Text:

SECURITY EXPECTED RETURN BETA Pete Corp. Repete Co. 1.15 .1185 .0941 .85

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

Here we have the expected return and beta for two assets We can e...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Suppose you observe the following 1-year interest rates, spot exchange rates and futures prices. Futures contracts are available on 10,000. How much risk-free arbitrage profit could you make on 1...

-

Suppose you observe the following month-end stock prices for stocks A and B: For each stock: a. Compute the mean monthly continuously compounded return. What is the annual return? b. Compute the mean...

-

Suppose you observe the following month-end stock prices for stocks A and B: For each stock: a. Compute the mean monthly continuously compounded return. What is the annual return? b. Compute the mean...

-

When something burns, a. it combines with phlogiston b. it gives off phlogiston c. it combines with oxygen d. it gives off oxygen

-

A recent study indicates that people tend to select video game avatars with characteristics similar to those of their creators (Blisle & Onur, 2010). Participants who had created avatars for a...

-

Assuming @Weather is a valid repeatable annotation that takes a String, with its associated containing type annotation @Forecast, which of the following can be applied to a type declaration? (Choose...

-

The CEO of the company asks you to justify the 10 percent increase in sales training expenditures for next year. How would you satisfy this request by the CEO?

-

Saddle Inc. has two types of handbags: standard and custom. The controller has decided to use a plant-wide overhead rate based on direct labor costs. The president has heard of activity-based costing...

-

The monthly income of investor is $9,000 per month, and up to 30% of the family income can be used to pay back a mortgage loan . His bank offers him a 30-year mortgage loan with a 2.5% interest rate....

-

The following 2016 information is available for Stewart Company: Condensed Income Statement for 2016 Sales $9,000 Cost of goods sold (6,000) Other expenses (2,000) Loss on sale of equipment (260)...

-

Consider the following information on Stocks I and II: The market risk premium is 7.5 percent, and the risk-free rate is 3 percent. Which stock has the most systematic risk? Which one has the most...

-

Suppose you observe the following situation: a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and Stock As beta is greater than Stock Bs beta by .43,...

-

ABC pharmaceutical corp. is planning on undertaking a new project, the initial cash outlay is $50,000 with projected cash inflows of $20,000 per year for the projects 4-year life, assuming a cost of...

-

Find a company or industry in the Country of Zimbabwe that can be defined as monopolistic. Describe the company/industry . Provide historical background as to why the country benefits from the...

-

On January 1, 2022, Swifty Company purchased equipment for $337000. The equipment is estimated to have a salvage value of $19000 and is being depreciated over five years using the...

-

Using the following information, what is the cost to buy a car? Down payment Monthly loan payment Opportunity cost of down payment Estimated value of vehicle at end of ownership period $3,000 $350...

-

It is your job to make all financial decisions for your company. In this role-play you will make decisions about purchasing insurance for your company. To make things easy, we will focus only on the...

-

Create a chart that compares different economic systems. You should focus on command, free enterprise (market), and mixed economic systems. Compare and contrast the following: production and...

-

Solve each rational inequality. Give the solution set in interval notation. x + 2 3 + 2x 5

-

From a medical tourist perspective, compare Shouldice with the traditional hospital in terms of the key factors of competition. Using Table 15-3, why would Shouldice attract patients from outside the...

-

Terri Simmons is single and had $189,000 in taxable income. Using the rates from Table 2.3 in the chapter, calculate her income taxes. What is the average tax rate? What is the marginal tax rate?...

-

Sheaves, Inc., has sales of $22,400, costs of $11,600, depreciation expense of $2,200, and interest expense of $1,370. If the tax rate is 22 percent, what is the operating cash flow, or OCF?

-

Earnhardt Driving Schools 2018 balance sheet showed net fixed assets of $1.28 million, and the 2019 balance sheet showed net fixed assets of $1.43 million. The companys 2019 income statement showed a...

-

Mackenzie Corp. is preparing the December 31, 2023, year-end financial statements. Following are selected unadjusted account balances: Estimated warranty liability $ 6,650 Income tax expense Mortgage...

-

Kubin Company's relevant range of production is 20,000 to 23,000 units. When it produces and sells 21,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $...

-

Write a program call seq-multiplier which will print out numbers in a sequence multiplied by a number input by a user. Your program should store the sequence [52, 1, 34, 23, 18, -9, 21, 4, 79] in a...

Study smarter with the SolutionInn App