Suppose that in July 2013, Nike had EPS of $2.52 and a book value of equity of

Question:

a. Using the average P/E multiple in Table 7.2 , estimate Nike€™s share price.

b. What range of share prices do you estimate based on the highest and lowest P/E multiples in Table 7.2 ?

c. Using the average price to book value multiple in Table 7.2 , estimate Nike€™s share price.

d. What range of share prices do you estimate based on the highest and lowest price to book value multiples in Table 7.2 ?

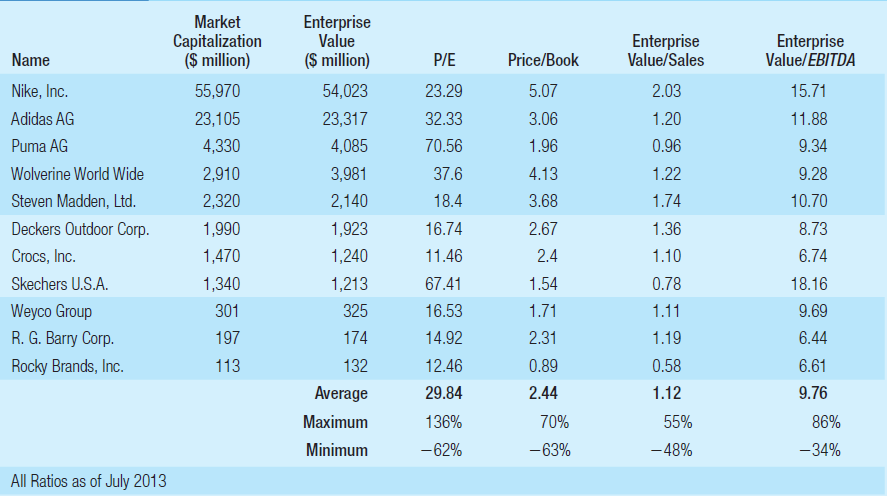

Table 7.2

Stock prices and Multipliers for the Footwear Industry (excluding Nike), July 2013

Enterprise Value ($ million) Market Enterprise Value/Sales Capitalization ($ million) Enterprise Value/ÉBITDA Name P/E Price/Book 54,023 5.07 2.03 Nike, Inc. 55,970 23.29 15.71 Adidas AG 23,105 1.20 11.88 23,317 32.33 3.06 1.96 Puma AG 4,330 4,085 70.56 0.96 9.34 Wolverine World Wide 3,981 9.28 2,910 37.6 4.13 1.22 2,320 1.74 Steven Madden, Ltd. 2,140 18.4 3.68 10.70 Deckers Outdoor Corp. 1.36 1,990 1,923 16.74 2.67 8.73 Crocs, Inc. 1,470 1,240 11.46 2.4 1.10 6.74 1.54 Skechers U.S.A. 1,340 1,213 67.41 0.78 18.16 301 1.71 1.11 Weyco Group 325 16.53 9.69 R. G. Barry Corp. 2.31 6.44 197 174 14.92 1.19 132 6.61 Rocky Brands, Inc. 113 12.46 0.89 0.58 1.12 Average 29.84 2.44 9.76 Maximum 136% 70% 55% 86% Minimum -62% -63% -48% -34% All Ratios as of July 2013

Step by Step Answer:

Plan Compute various estimates of the value of a share of Nike Execute a Using the average enterpris...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-0321818171

2nd Canadian edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Related Video

Constant Growth Dividend Discount Model – This dividend discount model assumes dividends grow at a fixed percentage. They are not variable and are consistent throughout. Variable Growth Dividend Discount Model or Non-Constant Growth model

Students also viewed these Business questions

-

Suppose that in May 2010, Nike had EPS of $3.51 and a book value of equity of $18.92 per share. a. Using the average P/E multiple in Table 10.1, estimate Nike's share price. b. What range of share...

-

Suppose that in July 2013, Nike had sales of $25,313 million, EBITDA of $3,254 million, excess cash of $3,337 million, $1,390 million of debt, and 893.6 million shares outstanding. a. Using the...

-

Kings of Leon, Inc., has a book value of equity of $62,000. Longterm debt is $55,000. Net working capital, other than cash, is $21,800. Fixed assets are $91,600. How much cash does the company have?...

-

For the given values, determine the quadrant(s) in which the terminal side of the angle lies. cos = 0.5000

-

Patricia Derbyshire and Ann Oleksiw are interested in starting a marketing company that will focus on branding for performers and musicians in the entertainment industry. Patricia is very creative...

-

Identify if the expression is a sum of cubes, difference of cubes, or neither. 2 5 ???? 3 + 8

-

The North Atlantic Consortium of Nephrology Associations (NACNA) is made up of two professional societies, the North American Nephrologist Society (NANS) and the European Council on Nephrology (ECN)....

-

Each rear tire on an experimental airplane is supposed to be filled to a pressure of 40 pound per square inch (psi). Let X denotes the actual air pressure for the right tire and Y denotes the actual...

-

Use the following information for Cookies, Inc. to prepare an Income Statement, Statement of Changes in Stockholders' Equity and Balance Sheet at the end of the current year on this form. Common...

-

The following data give the percentage of women working in five companies in the retail and trade industry. The percentage of management jobs held by women in each company is also shown. a. Develop a...

-

Assume that Coca-Cola Company has a share price of $43. The firm will pay a dividend of $1.24 in one year, and you expect Coca-Cola to raise this dividend by approximately 7% per year in perpetuity....

-

Consider the valuation of Nike given in Example 7.7. a. Suppose you believe Nikes initial revenue growth rate will be between 7% and 11% (with growth slowing linearly to 5% by year 2018). What range...

-

Avery Island Dairy is a boutique cheese maker based on Avery Island, Louisiana. Over the years, the business has grown by supplying local retailers and through exports. In addition, there is a...

-

(b) Show how you would implement the functions F and G using a PAL where f(a, b, c) = a'b + ac' g(a, b, c) = ab + ab'c'. Be sure to label your inputs and outputs. Do not minimize the functions. D D D...

-

Daisy Company received a bank statement for February, as follows: 1 2 3 4 3 4 5 Date Feb. 1 6 7 9 14 16 21 23 28 8 Checks $ 2,700.33 3,484.81 The receipt of $460 on February 14 was for a $445 note...

-

Exercise 2 E [4 points]. Given a training set D = {(x(i), y(i)), i = 1, .., M}, where x() RN and y() {1,2, ..., C}, derive the maximum likelihood estimates of the naive Bayes for real valued xmodeled...

-

Write C++ program to compute the following equation: S3 + sin(13) 11 F = Z 5M * 2

-

III. IV. Given the figure below. P Pi If (4, B; C, D) = 3, determine the following: (8 points each) 12. (C, D'; B', A') 13. (D', A'; B', C') 15. (B4, D4; A4,C4) A = Use the figure below to answer...

-

(i) Show that if A, S and E are, respectively, isotropic smoothing (averaging), sharpening (high-boost) and edge-detection (high-pass) filters described in the spatial domain, and I is the identity...

-

Identify Thank You mission, strategy and core competencies. Identify strategy changes that have taken place at Thank You since its founding in 2008. Your answer must in text references and must be...

-

Suppose that in 2011, Global launched an aggressive marketing campaign that boosted sales by 15%. However, their operating margin fell from 5.57% to 4.50%. Suppose that they have no other income,...

-

What was the change in Global's book value of equity from 2010 to 2011 according to Table 2.1? Does this imply that the market price of Global's shares increased in 2011? Explain.

-

What is the role of an auditor?

-

Explain why leasing is an option for a company expansion. include, what leasing is and how it will benefit the company in it's expanding efforts. Also, how is capital or operating leasing recorded on...

-

Discuss the following statement: " A head of state signs a treaty on behalf of his country in excess of authority of his country, such treaty shal be void for inconsistency with domestic law of the...

-

A company is looking at new equipment with an installed cost of $415,329. This cost will be depreciated straight-line to zero over the project's 5-year life, at the end of which the equipment can be...

Study smarter with the SolutionInn App