Algernon, a small proprietorship owned by an unmarried individual, has a taxable income of $80,000. What is

Question:

Algernon, a small proprietorship owned by an unmarried individual, has a taxable income of $80,000. What is its tax bill? Its average tax rate? Its marginal tax rate?

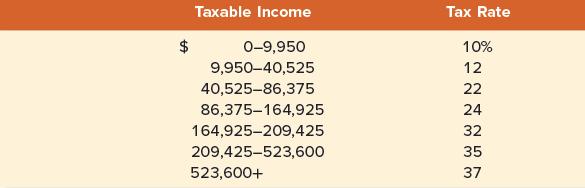

From Table 2.3, we see that the tax rate applied to the first $9,950 is 10 percent; the rate applied over that up to $40,525 is 12 percent; the rate applied after that up to our total of $80,000 is 22 percent. So Algernon must pay .10 × $9,950 + .12 × ($40,525 − 9,950) + .22 × ($80,000 − 40,525) = $13,348.50. The average tax rate is thus $13,348.50/$80,000 = .1669, or 16.69%. The marginal rate is 22 percent because Algernon’s taxes would rise by 22 cents if it earned another dollar in taxable income.

Table 2.3

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe