Commons plc has distributable earnings of 120m, a weighted average cost of capital of 7 per cent

Question:

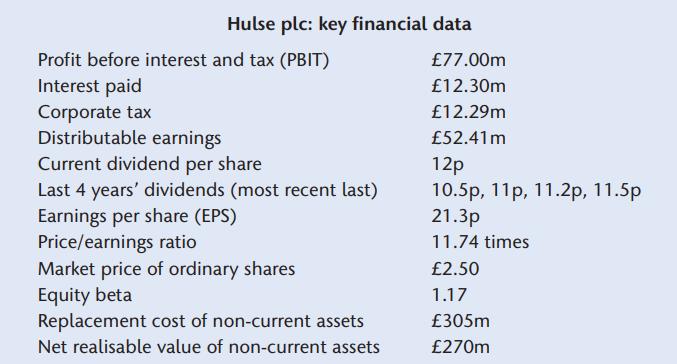

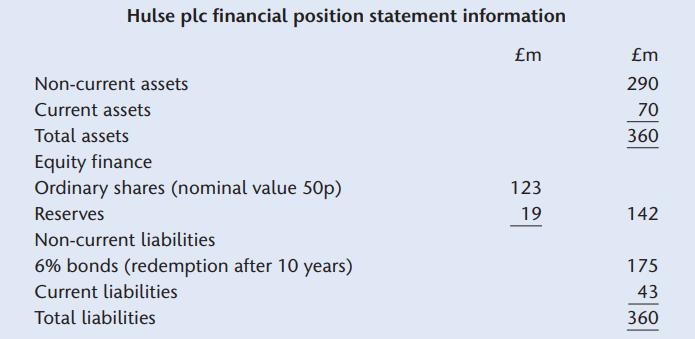

Commons plc has distributable earnings of £120m, a weighted average cost of capital of 7 per cent and a price/earnings ratio of 18.2 times. It is in the process of taking over Hulse plc, whose financial details are as follows:

Commons plc expects to maintain an annual increase in distributable earnings of 2 per cent due to anticipated synergy as a result of the takeover. The company will also be able to sell surplus non-current assets for £60m in two years’ time. The current estimate of cash flows of Hulse plc is £38m, but these are expected to grow at an annual rate of 4 per cent in future years. The risk-free rate of return is 4.5 per cent and the equity risk premium is 5 per cent. Companies in the same sector as Hulse plc have an average price/earnings ratio of 15.5 times and a weighted average cost of capital of 9 per cent.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head