Consider a firm whose debt has a market value of $40 million and whose stock has a

Question:

Consider a firm whose debt has a market value of $40 million and whose stock has a market value of $60 million. The firm pays a 5 percent rate of interest on its new debt and has a beta of 1.41. The corporate tax rate is 21 percent. Assume that the CAPM holds, the risk premium on the market is 9.5 percent, and the current Treasury bill rate is 1 percent. What is this firm’s WACC?

To compute the WACC using Equation 13.8, we must know

(1) The aftertax cost of debt, R B × (1 − TC);

(2) The cost of equity, RS;

(3) The weights of debt and equity used by the firm.

These three values are determined next:

1. The pretax cost of debt is 5 percent, implying an after tax cost of 3.95 percent [= .05 × (1 − .21)] .

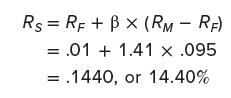

2. We calculate the cost of equity capital by using the CAPM:

3. We compute the proportions of debt and equity from the market values of debt and equity.

Because the market value of the firm is $100 million ( = $40 million + 60 million ) , the proportions of debt and equity are 40 and 60 percent, respectively.

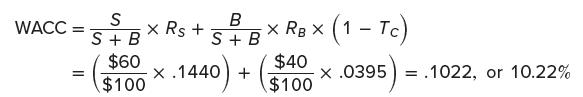

The cost of equity, R S , is 14.40 percent and the after tax cost of debt, R B × (1 − TC), is 3.95 percent. B is $40 million and S is $60 million. Therefore:

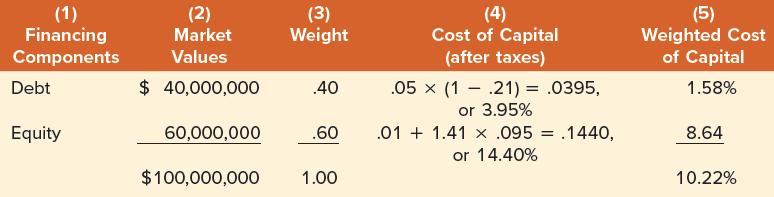

The above calculations are presented in table form below:

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe