It is 1 January, and a UK company expects to receive $300,000 in three months time. Being

Question:

It is 1 January, and a UK company expects to receive $300,000 in three months’ time. Being concerned about the pound strengthening against the dollar, it decides to use CME-traded currency futures to hedge its transaction risk.

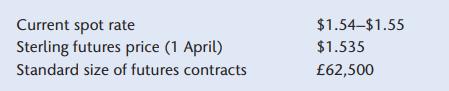

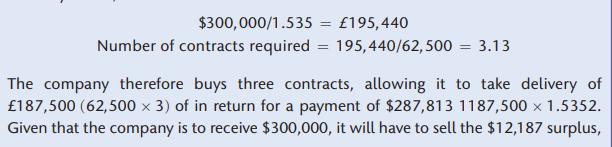

The first thing to establish is whether the company should buy or sell futures contracts. Given that holding a futures contract (often referred to as taking a long position) allows future delivery of a foreign currency, and that in this case sterling is the foreign currency, the company should buy US sterling futures. This allows the company to take delivery of sterling in return for the dollars it expects to receive. The futures price quoted is the number of US dollars needed to buy one unit of the foreign currency. Translating the expected dollar receipt into sterling at the exchange rate implicit in the currency future, we have:

either now via a forward exchange contract or in the future at the spot rate in three months’ time. We can see that the company has locked into a particular exchange rate ($1.535/£) and knows how much sterling it will receive from its future dollar receipts, except (perhaps) for the $12,187 surplus. In this example the company has underhedged by using three contracts when it needed 3.13 contracts for a perfect hedge

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head