Kopperud Electronics has an investment opportunity to produce a new HDTV. The required investment on January 1

Question:

Kopperud Electronics has an investment opportunity to produce a new HDTV. The required investment on January 1 of this year is $125 million.

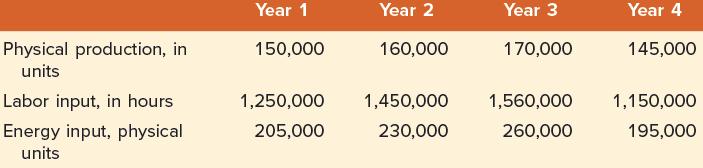

The firm will depreciate the investment to zero using the straight-line method over four years. The investment has no resale value after completion of the project. The firm is in the 21 percent tax bracket. The price of the product will be $435 per unit, in real terms, and will not change over the life of the project. Labor costs for Year 1 will be $16.25 per hour, in real terms, and will increase at 2 percent per year in real terms. Energy costs for Year 1 will be $4.35 per physical unit, in real terms, and will increase at 3 percent per year in real terms. The inflation rate is 5 percent per year. Revenues are received and costs are paid at year-end. Refer to the following table for the production schedule:

The real discount rate for the project is 4 percent. Calculate the NPV of this project.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe