NML plc is considering buying a new machine costing 200,000 which would generate the following before-tax cash

Question:

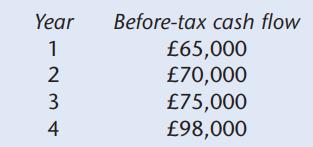

NML plc is considering buying a new machine costing £200,000 which would generate the following before-tax cash flows from the sale of goods produced.

NML pays corporation tax of 19 per cent per year one year in arrears and claims capital allowances on a 18 per cent reducing balance basis. The machine would be sold after four years for £20,000. If NML’s after-tax cost of capital is 10 per cent, is the purchase of the machine financially acceptable?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head

Question Posted: