The Cooney Corporation has fixed assets with a book value of $700 and an appraised market value

Question:

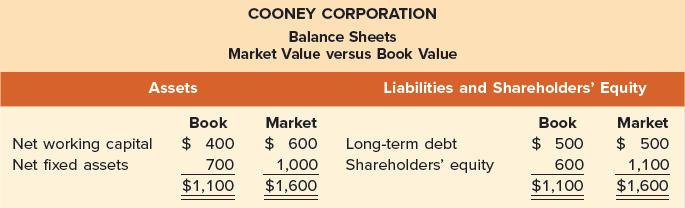

The Cooney Corporation has fixed assets with a book value of $700 and an appraised market value of about $1,000. Net working capital is $400 on the books, but approximately $600 would be realized if all the current accounts were liquidated.

Cooney has $500 in long-term debt, in book value and market value terms. What is the book value of the equity? What is the market value?

We can construct two simplified balance sheets, one in accounting (book value) terms and one in economic (market value) terms:

In this example, shareholders’ equity is actually worth almost twice as much as what is shown on the books. The distinction between book and market values is important precisely because book values can be so different from market values.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe