World-Wide Enterprises (WWE) is a large conglomerate thinking of entering the widget business, where it plans to

Question:

World-Wide Enterprises (WWE) is a large conglomerate thinking of entering the widget business, where it plans to finance projects with a debt-value ratio of 25 percent (or a debt-equity ratio of 1/3). There is currently one firm in the widget industry, American Widgets (AW). This firm is financed with 40 percent debt and 60 percent equity. The beta of AW’s equity is 1.5. AW has a borrowing rate of 12 percent, and WWE expects to borrow for its widget venture at 10 percent. The corporate tax rate for both firms is 21 percent, the market risk premium is 8.5 percent, and the risk-free interest rate is 8 percent. What is the appropriate discount rate for WWE to use for its widget venture?

As shown in Sections 18.1–18.3, a corporation may use one of three capital budgeting approaches: APV, FTE, or WACC. The appropriate discount rates for these three approaches are R 0 , R S , and WACC, respectively. Because AW is WWE’s only competitor in widgets, we look at AW’s cost of capital to calculate R 0 , R S , and WACC for WWE’s widget venture. The following four-step procedure will allow us to calculate all three discount rates:

1. Determining AW’s cost of equity capital: First, we determine AW’s cost of equity capital using the security market line:![RS = RF + Bx [E(RM) - RF] = .08 + 1.5 x .085 = .2075, or 20.75%](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/5/4/4/931655c41a3daf6a1700544931544.jpg)

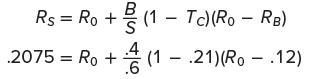

2. Determining AW’s hypothetical all-equity cost of capital: We must standardize the preceding number in some way because AW’s and WWE’s widget ventures have different target debtvalue ratios. The easiest approach is to calculate the hypothetical cost of equity capital for AW, assuming all-equity financing. This can be determined from MM’s Proposition II under taxes:

By solving the equation, we find that R 0 = .1773 , or 17.73 percent. Of course, R 0 is less than R S because the cost of equity capital would be less when the firm employs no leverage.

At this point, firms in the real world generally make the assumption that the business risk of their venture is about equal to the business risk of the firms already in the business.

Applying this assumption to our problem, we assert that the discount rate of WWE’s widget venture if all-equity-financed is also 17.73 percent.6 This discount rate would be employed if WWE uses the APV approach because the APV approach calls for R 0 , the project’s cost of capital in a firm with no leverage.

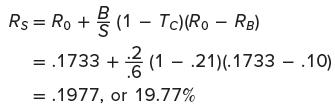

3. Determining R S for WWE’s widget venture: Alternatively, WWE might use the FTE approach, where the discount rate for levered equity is determined like this:

Note that the cost of equity capital for WWE’s widget venture, 19.77 percent, is less than the cost of equity capital for AW, 20.75 percent. This occurs because AW has a higher debt-equity ratio. (As mentioned, both firms are assumed to have the same business risk.)

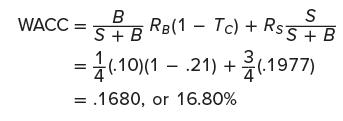

4. Determining WACC for WWE’s widget venture: Finally, WWE might use the WACC approach.

Here is the appropriate calculation:

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe