Yell plc wants to find the relative importance of the determinants of its cost of equity, namely

Question:

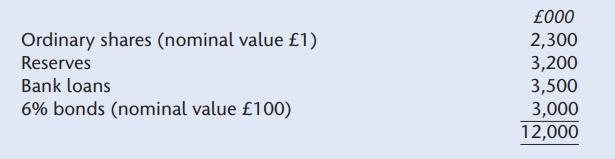

Yell plc wants to find the relative importance of the determinants of its cost of equity, namely the risk-free rate of return, business risk and financial risk. You have the following information:

1. The return on the market is 8.21 per cent per year.

2. The current yield of treasury bills is 3.34 per cent per year.

3. Corporation tax is currently 19 per cent.

4. The company’s current equity beta is 1.21.

5. The ex-dividend ordinary share price is £3.98 per share.

6. The ex-interest bond price is £123 per bond.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head

Question Posted: