You have collected the following information for the Slowpay Company: Credit sales for the year just ended

Question:

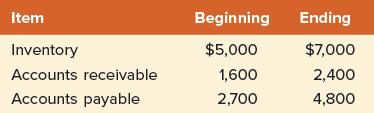

You have collected the following information for the Slowpay Company:

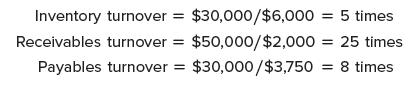

Credit sales for the year just ended were $50,000 and cost of goods sold was $30,000. How long does it take Slowpay to collect on its receivables? How long does merchandise stay around before it is sold? How long does Slowpay take to pay its bills? We can first calculate the three turnover ratios:

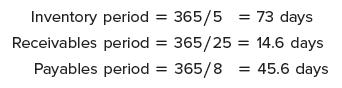

We use these to get the various periods:

All told, Slowpay collects on a sale in 14.6 days, inventory sits around for 73 days, and bills get paid after about 46 days. The operating cycle here is the sum of the inventory and receivables periods: 73 + 14.6 = 87.6 days. The cash cycle is the difference between the operating cycle and the payables period: 87.6 − 45.6 = 42 days.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe