Question: Below is given the standard deviation and correlation information on three South African companies, Afgri, Harmony Gold and SABMiller. (a) If a portfolio is made

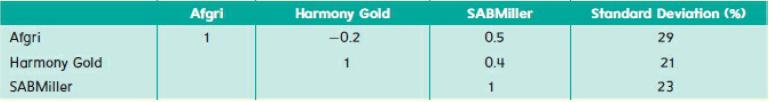

Below is given the standard deviation and correlation information on three South African companies, Afgri, Harmony Gold and SABMiller.

(a) If a portfolio is made up of 30 per cent of Afgri, 40 per cent of Harmony Gold and 30 per cent of SABMiller, estimate the portfolio’s standard deviation.

(b) If you were asked to design a portfolio using just Harmony Gold and Afgri, what percentage investment in each share would produce a zero standard deviation?

Afgri Harmony Gold SABMiller Afgri 1 Harmony Gold -0.2 1 SABMiller 0.5 0.4 1 Standard Deviation (%) 29 21 23

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Answer So for a zero stan... View full answer

Get step-by-step solutions from verified subject matter experts