Below, you are given the expected returns and standard deviations of LOreal and Daimler AG, the Euro

Question:

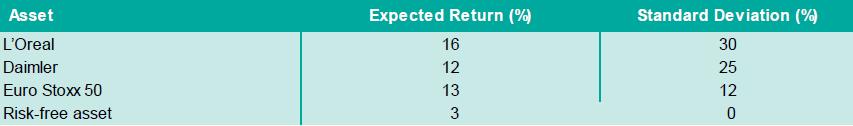

Below, you are given the expected returns and standard deviations of L’Oreal and Daimler AG, the Euro Stoxx 50 Index of largest Eurozone firms, and the risk-free asset.

1. Assuming that the returns are explained by the capital asset pricing model, calculate the betas of L’Oreal and Daimler and the risk of a portfolio holding L’Oreal and Daimler with an expected return the same as the Euro Stoxx 50 Index return. (20 marks)

2. Construct a portfolio consisting of the Euro Stoxx 50 Index and the risk-free asset that will produce an expected return of 12 per cent. Contrast the risk on this portfolio with the risk of Daimler. (20 marks)

3. Assuming that the expected return on an average security is 13 per cent with a standard deviation of 26 per cent and the average covariance of returns between securities is +

100, determine the expected risk of a portfolio with 28 securities and a portfolio with 1,000 securities. Comment briefly on your results. (20 marks)

4. Now assume that the returns on securities are independent. Continuing to assume that the expected return on an average security is 13 per cent with a standard deviation of 26 per cent, determine the risk of a portfolio with 28 securities and 1,000 securities. Comment on your results. (20 marks)

5. Explain what is meant by the separation principle. (20 marks)

Step by Step Answer:

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe