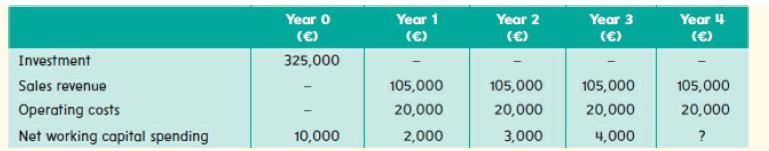

Carlsberg is considering a new retail lager investment in Copenhagen. Financial projections for the investment are tabulated

Question:

Carlsberg is considering a new retail lager investment in Copenhagen. Financial projections for the investment are tabulated here. The Danish corporate tax rate is 25 per cent and the investment is depreciated using 20 per cent reducing balances. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project and the investment is sold at its residual value after depreciation.

(a) Compute the incremental net income of the investment for each year.

(b) Compute the incremental cash flows of the investment for each year.

(c) Suppose the appropriate discount rate is 12 per cent. What is the NPV of the project?

Step by Step Answer:

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe