Question: Consider the table below. Using either the historical return or expected return and Solver, compute the minimum variance portfolio for the universe of three Norwegian

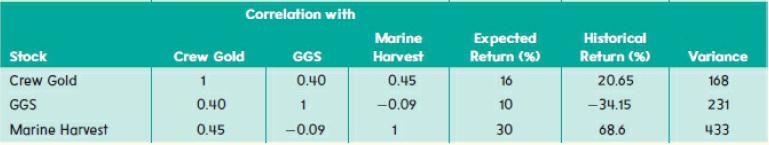

Consider the table below. Using either the historical return or expected return and Solver, compute the minimum variance portfolio for the universe of three Norwegian shares, Crew Gold, GGS and Marine Harvest, described below. Assume the risk-free return is 6 per cent. Which return measure did you use and why?

Stock Crew Gold GGS Marine Harvest Correlation with Crew Gold 1 0.40 0.45 GGS 0.40 1 -0.09 Marine Harvest 0.45 -0.09 1 Expected Return (%) 16 10 30 Historical Return (%) 20.65 -34.15 68.6 Variance 168 231 433

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts