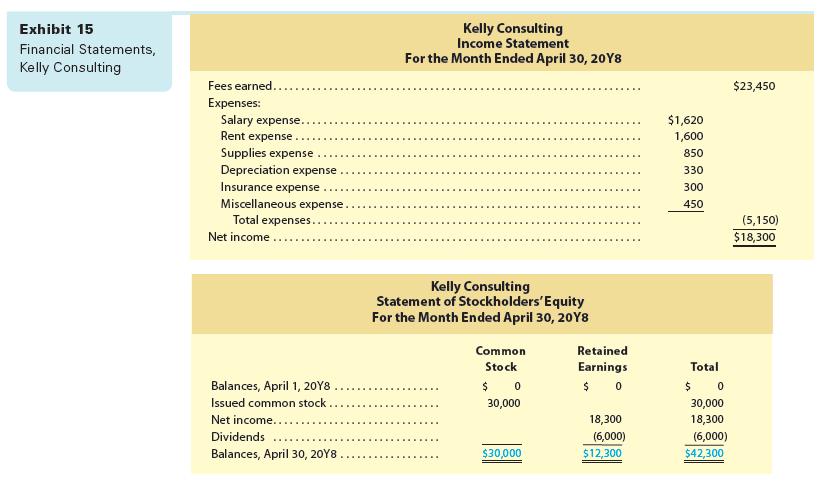

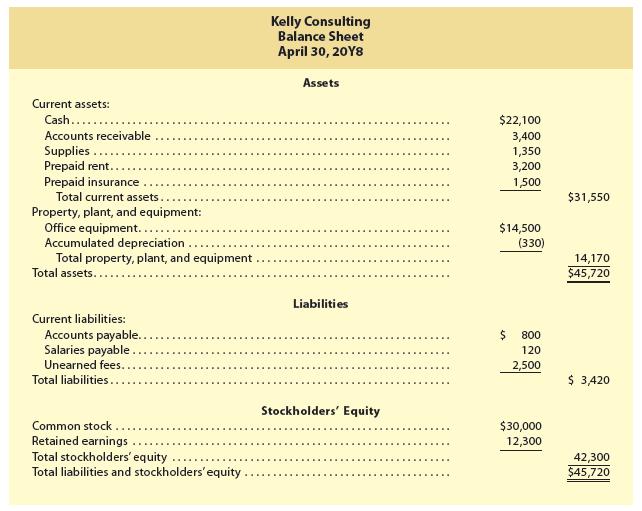

In Exhibit 15, Kelly Consulting reported accrual net income of $18,300. Under the cash basis of accounting,

Question:

In Exhibit 15, Kelly Consulting reported accrual net income of $18,300. Under the cash basis of accounting, Kelly Consulting would have reported net income of $15,000.

a. Why are the accrual- and cash-basis net incomes different?

b. Provide an example of an April cash receipt of Kelly Consulting that is recorded differently under the accrual and cash bases of accounting.

c. Provide an example of an April cash payment of Kelly Consulting that is recorded differently under the accrual and cash bases of accounting.

d. From the December transactions of Kelly Consulting, provide an example of a cash payment that is recorded the same under the accrual and cash bases of accounting.

e. Why is the accrual basis of accounting required by generally accepted accounting principles (GAAP)?

Exhibit 15

Step by Step Answer: