Temporary revenue and expense timing differences between income before income taxes and taxable income for four years

Question:

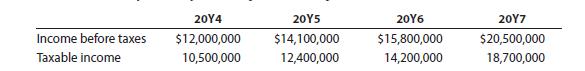

Temporary revenue and expense timing differences between income before income taxes and taxable income for four years of Jaffe Corporation’s operations are as follows:

Assume that Jaffe Corporation’s income tax rate for each year is 20% and that all tax payments are made when due.

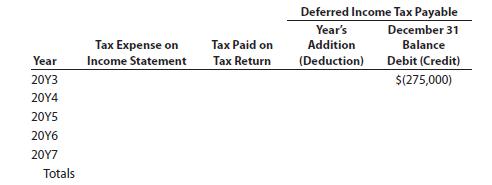

a. Assume that Deferred Tax Payable has a credit balance of $275,000 on December 31, 20Y3. Complete the following table:

b. Over the life of a corporation, will the total tax expense on the income statements equal the total tax paid on the tax returns? Explain.

c. On December 31, 20Y3, Jaffe Corporation had a credit balance of $275,000 in Deferred Income Tax Payable. Using your answer to part (a), did this balance increase or decrease from January 1, 20Y4, to December 31, 20Y7? If so, why?

Step by Step Answer: