Using your answers for Target Corporation (TGT) in MAD 1-2 and Walmart Inc. (WMT) in MAD 1-3,

Question:

Using your answers for Target Corporation (TGT) in MAD 1-2 and Walmart Inc. (WMT) in MAD 1-3, compare and interpret Target’s ratio of liabilities to stockholders’ equity to that of Walmart.

MAD 1-2

Target Corporation (TGT) is one of the largest retailers in the United States. Target operates over 1,800 stores that sell a wide assortment of merchandise, including a variety of grocery items.

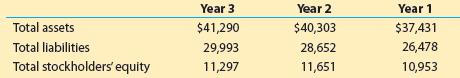

Target recently reported the following end-of-year balance sheet data (in millions):

a. Compute the ratio of liabilities to stockholders’ equity for all three years. Round to two decimal places.

b. What conclusions regarding the margin of protection to creditors can you draw from the trend in this ratio for the three years?

MAD 1-3

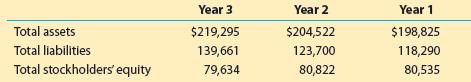

Walmart Inc. (WMT), a major competitor to Target Corporation (TGT) in the retail business, operates over 11,000 stores. Walmart recently reported the following end-of-year balance sheet data (in millions):

a. Compute the ratio of liabilities to stockholders’ equity for all three years. Round to two decimal places.

b. What conclusions regarding the margin of protection to creditors can you draw from the trend in this ratio for the three years?

Step by Step Answer: