Kevin Brown is the management accountant at Boehm and Sons Bank. Some of his colleagues attended a

Question:

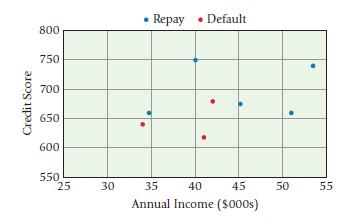

Kevin Brown is the management accountant at Boehm and Sons Bank. Some of his colleagues attended a conference recently where they learned that machine learning can be used to accurately predict loan performance. Excited by the possibilities, they asked Kevin to work with the data science team to develop a machine learning model that predicts whether a loan will repay or default. Kevin knows that defaulting loans have significantly hurt Boehm and Sons’ profitability. Kevin tells the data science team that his colleagues will appreciate a model that is interpretable and easy to understand, so they decide to use a decision tree. The team selects a random sample of eight loans (three loans that defaulted and five loans that repaid) from Boehm and Sons’ internal loan database and begins the analysis.

Required:

1. Use your ruler to identify two possible places to make the first cut. Visually, is one of these cuts better than the other at separating the data?

2. For each potential cut, calculate the Gini impurity and the information gain. Based on these calculations, which cut should be used to form the first node of the decision tree? Is this consistent with your visual intuition from requirement 1?

3. How could Kevin use the decision tree analysis to help senior managers at Boehm and Sons improve profitability?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9781292363073

17th Global Edition

Authors: Srikant Datar, Madhav Rajan