The data science team at Swift Investments uses a sample of 16 loans to build a decision

Question:

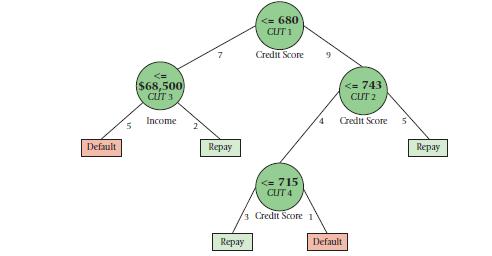

The data science team at Swift Investments uses a sample of 16 loans to build a decision tree that predicts whether a loan will repay or default. Although the data science team is very familiar with decision trees and other machine learning models, they do not have much experience in the finance or lending industries. The team shows the decision tree to Royce Brown, the management accountant at Swift, who indicates that some of the decisions made by the model seem incorrect. To understand how the decision tree partitions the data, the team writes out the rules and thinks through some examples.

Required:

1. Write out the rules dictated by this decision tree.

2. How would the decision tree classify the following loans?

a. Borrower has a credit score of 650 and income of $62,000

b. Borrower has a credit score of 670 and income of $75,500

c. Borrower has a credit score of 690 and income of $58,000

d. Borrower has a credit score of 725 and income of $62,000

3. Is Brown correct that something is wrong with the model? If so, what might explain this? Why is understanding the model important to Brown in his role as a management accountant?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9781292363073

17th Global Edition

Authors: Srikant Datar, Madhav Rajan