Question: CVP Analysis with Semifixed Costs and Changing Unit Variable Costs: Torous Company manufactures and sells one product. The sales price, $50 per unit, remains constant

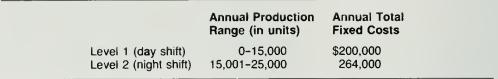

CVP Analysis with Semifixed Costs and Changing Unit Variable Costs: Torous Company manufactures and sells one product. The sales price, $50 per unit, remains constant regardless of volume. Last year's sales were 12,000 units, and operating profits were -$20,000 (i.e., a loss). "Fixed" costs depended on production levels, as shown below. Variable costs per unit are 20 percent higher in level 2 (night shift) than in level 1 (day shift) because of additional labor costs due primarily to higher wages required to employ workers for the night shift.

Last year's cost structure and selling price are not expected to change this year. Maximum plant capacity is 25.000 units. The company sells everything it produces.

Required:

a. Compute the contribution margin per unit for last year for each of the two production levels.

b. Compute the break-even points for last year for each of the two production levels.

c. Compute the volume in units that will maximize operating profits. Defend your choice.

Level 1 (day shift) Level 2 (night shift) Annual Production Range (in units) 0-15,000 15,001-25,000 Annual Total Fixed Costs $200,000 264,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts