Question: CVP analysis with semifixed costs and changing unit variable costs. The Arganon Company manufactures and sells crystal earrings. The sales price, $50 per unit, remains

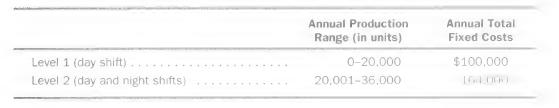

CVP analysis with semifixed costs and changing unit variable costs. The Arganon Company manufactures and sells crystal earrings. The sales price, $50 per unit, remains constant regardless of volume. Last year's sales were 15,000 units and operating profits were $200,000. Fixed costs depend on production levels, as the following table shows. Variable costs per unit are 40 percent higher for level 2 (two shifts) than for level 1 (day shift only). The additional labor costs result primarily from higher wages required to employ workers for the night shift.

Arganon expects last year's cost structure and selling price not to change this year.

Maximum plant capacity is 36,000. The company sells everything it produces.

a. Compute the contribution margin per unit for last year for each of the two production levels.

b. Compute the break-even points in units for last year for each of the two production levels.

c. Compute the volume in units that will maximize operating profits. Defend your choice.

Level 1 (day shift). Level 2 (day and night shifts) Annual Production Range (in units) 0-20,000 20,001-36,000 Annual Total Fixed Costs $100,000 1644:00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts