Question: Paul and Maggie Lobster Company is considering the purchase of equipment that will enable it to raise its own lobsters. The following information about the

Paul and Maggie Lobster Company is considering the purchase of equipment that will enable it to raise its own lobsters. The following information about the investment is available: mkio74

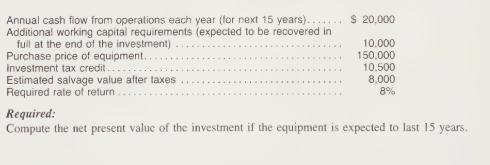

Annual cash flow from operations each year (for next 15 years).. Additional working capital requirements (expected to be recovered in full at the end of the investment) Purchase price of equipment... Investment tax credit. Estimated salvage value after taxes Required rate of return. Required: $ 20,000 10,000 150,000 10.500 8,000 8% Compute the net present value of the investment if the equipment is expected to last 15 years.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts