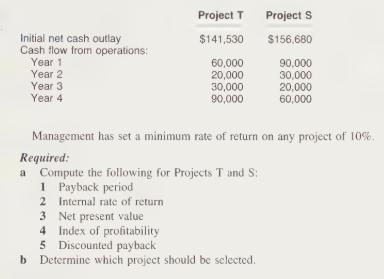

Question: Pescow Dairy Corporation is considering the following two mutually exclusive projects: mki72 Project T Project S Initial net cash outlay $141,530 $156,680 Cash flow from

Pescow Dairy Corporation is considering the following two mutually exclusive projects: mki72

Project T Project S Initial net cash outlay $141,530 $156,680 Cash flow from operations: Year 1 60,000 90,000 Year 2 20,000 30,000 Year 3 30,000 20,000 Year 4 90,000 60,000 Management has set a minimum rate of return on any project of 10%. Required: a Compute the following for Projects T and S: 1 Payback period 2 Internal rate of return 3 Net present value 4 Index of profitability 5 Discounted payback b Determine which project should be selected.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts