On January 1, 2021, Gundy Enterprises purchases an office for $360,000, paying $60,000 down and borrowing the

Question:

On January 1, 2021, Gundy Enterprises purchases an office for $360,000, paying $60,000 down and borrowing the remaining $300,000, signing a 7%, 10-year mortgage. Installment payments of $3,483.25 are due at the end of each month, with the first payment due on January 31, 2021.

Required:

1. Record the purchase of the building on January 1, 2021.

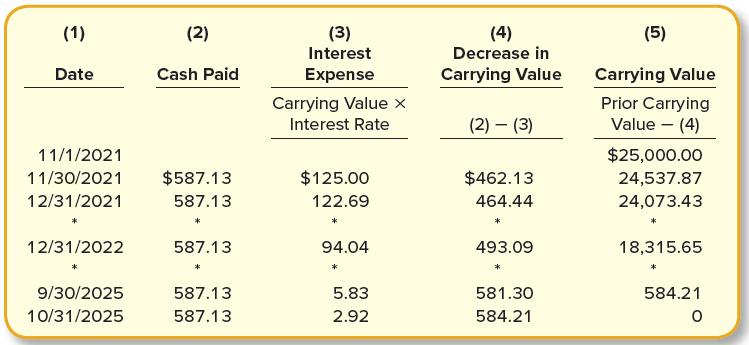

2. Complete the first three rows of an amortization schedule similar to Illustration 9–1.

3. Record the first monthly mortgage payment on January 31, 2021. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan?

4. Total payments over the 10 years are $417,990 ($3,483.25 × 120 monthly payments). How much of this is interest expense and how much is actual payment of the loan?

Illustration 9-1

Step by Step Answer:

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann