1. The information in Problem 9-50 presents a decision problem similar to the choice of cost structure...

Question:

1. The information in Problem 9-50 presents a decision problem similar to the choice of cost structure (variable vs. fixed) discussed in the chapter. Here, the issue is whether to pay an upfront premium (extra fixed cost) for the hybrid model in exchange for lower variable costs over the life of the vehicle. In a typical CVP model, we are able, at any output level (X), to calculate a measure of profit sensitivity, which we call the degree of operating leverage (DOL). In the present context, which involves only costs for each vehicle over a five-year period, we cannot calculate DOL, but we might calculate an analogous measure: the ratio of percentage change in lifetime cost to percentage change in miles. Refer to this as a pseudo-DOL. Calculate this pseudo measure for each decision alternative, from a base of 100,000 lifetime miles. To calculate the percentage change figures, use 105,000 miles. What information is conveyed in the two measures you calculated?

2. The preceding calculations give you some of the information you need to make your decision. However, being the inquisitive type, you want more information. For example, you are wondering whether, in the present context (i.e., decision choice), the price of gas (per gallon) has much of an impact on the financial consequence regarding the choice of automobile. To explore this issue further, you decide to construct a decision table. As pointed out in the text, a decision table discloses combinations of actions (here, choice of automobile) and events (here, lifetime miles driven and mpg performance of each auto). Prepare a decision table that discloses the breakeven point in gas price for 90,000 miles, 100,000 miles, and 110,000 miles for each of five situations regarding the difference in initial cost (after rebate) between the gasoline-powered model and the hybrid model. Construct your table based on the following initial cost differences between the two: $5,000, $6,000, $7,000 (the base case, based on original data), $8,000, and $9.000. [Hint: With five different initial cost differences and three alternatives for lifetime miles driven, your decision table should disclose 15 (i.e., 5 × 3) breakeven points in terms of price per gallon of gas.] Interpret a couple of points from the decision table you constructed.

3. The following probabilities (p) apply to the set of possible events (price of gas, per gallon) listed in requirement 3 for Problem 9-50: 0.05, 0.07, 0.08, 0.10, 0.12, 0.18, 0.15, 0.12, 0.10, and 0.03. Your decision consists of one of two actions: buy the hybrid model or buy the gasoline-powered model. Given this set of probabilities and events, calculate the expected value of the lifetime cost associated with each action (decision choice) under the assumption that lifetime miles driven = 100,000. For each action, the expected value of lifetime cost, E(ai), is the weighted average of outcomes (lifetime costs), where the weights for each outcome are the outcome’s probability.

4. It is certainly possible that, in some scenarios, the lifetime cost of each of the two decision alternatives is very close, even indistinguishable. But even if there are significant differences in the financial result, other factors may sway a decision. What nonfinancial factors and other quantitative factors (beyond those considered earlier) might be relevant to your decision? Explain.

Problem 9-50

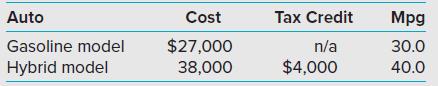

With the volatility of gasoline prices in recent years, consumers have moved to high miles-per-gallon (mpg) vehicles, in particular hybrid autos that rely on a battery as well as a gasoline engine for even greater mpg. The new vehicles save money on gas, but also reduce the motorist’s “carbon footprint” in an environment of global warming. To encourage the purchase of fuel-efficient vehicles such as hybrids, the government may provide incentives, including income-tax credits, which represent dollar-for-dollar reductions in the income tax liability of the individual in the year of purchase. As both a cost conscious and an environmentally conscious consumer, you are currently evaluating whether to purchase a hybrid vehicle. Assume that you have narrowed your decision down to two choices: a gasoline-powered vehicle or its equivalent hybrid (e.g., Honda Accord vs. Accord hybrid). Relevant information regarding each of these two vehicles is as follows:

Assume, further, that you plan to keep your auto for five years and that, based on recent experience, will likely drive the car 20,000 miles per year (100,000 miles in total).

Step by Step Answer: