Gunnell Inc. is considering two mutually exclusive 10-year investments. The initial cash outlays and expected net after-tax

Question:

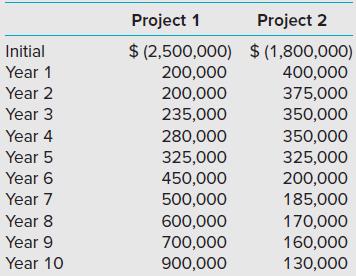

Gunnell Inc. is considering two mutually exclusive 10-year investments. The initial cash outlays and expected net after-tax cash flows are shown below.

Required

1. Using Excel, calculate the NPV and IRR of each project. Assume Gunnell Inc. uses a discount rate of 8%. Round your NPV answer to the nearest dollar and your IRR answer to two decimal points.

2. Which project would you recommend to Gunnell management? Are there strategic or risk factors that might lead you to recommend the project with the lower NPV? Explain with specific evidence.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: