The Marvis Company manufactures and sells a line of exclusive sportwear. The firms sales were ($650,000) for

Question:

The Marvis Company manufactures and sells a line of exclusive sportwear. The firm’s sales were \($650,000\) for the year just ended, and its total assets exceeded \($420,000.\) The company was started by Mr. Marvis just 10 years ago and has been profitable every year since its inception. The chief financial officer of the firm, Brandon Davis, has decided to seek a line of credit totaling \($85,000\) from the firm’s bank. In the past, the company has relied on its suppliers to finance a large part of its needs for inventory. However, in recent months, tight money conditions have led the firm’s suppliers to offer sizable cash discounts to speed up payments for purchases. Mr. Davis wants to use the line of credit to replace a large portion of the firm’s payables during the summer, which is the firm’s peak seasonal sales period.

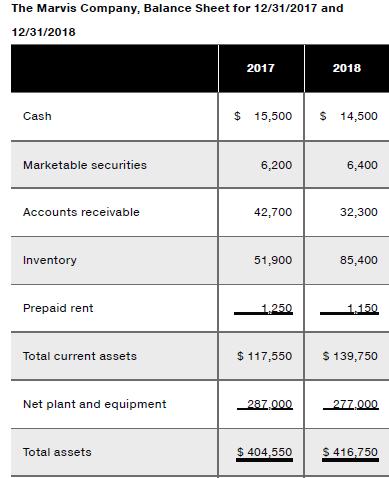

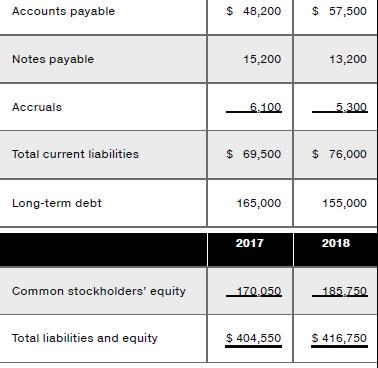

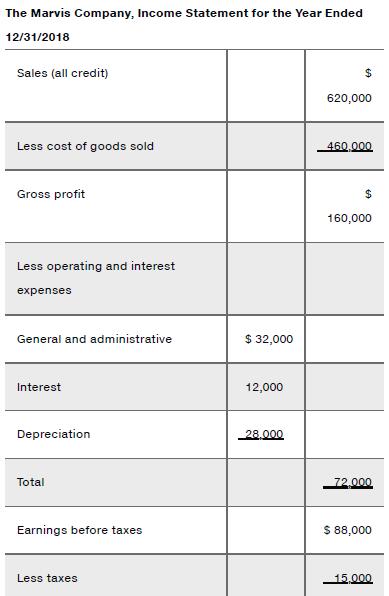

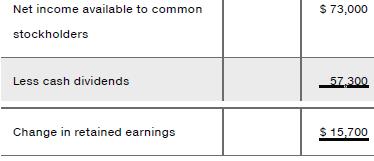

The firm’s two most recent balance sheets were presented to the bank in support of its loan request. In addition, the firm’s income statement for the year just ended was provided. These statements are found in the following tables:

Maurizio Grameen, associate credit analysis from the Chartered Mercantile Bank of Birmingham, United Kingdom, was assigned the task of analyzing Marvis’s loan request.

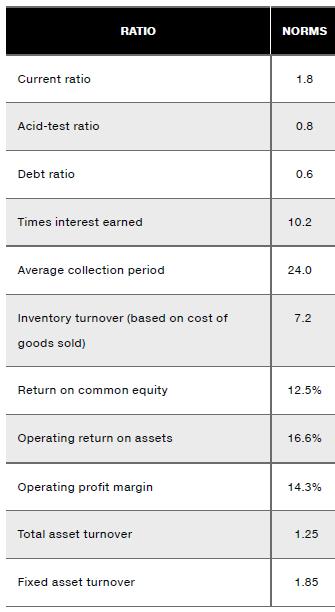

a. Calculate the financial ratios for 2018 corresponding to the industry norms provided as follows:

b. Which of the ratios reported in the industry norms do you feel should be the most crucial in determining whether the bank should extend the line of credit?

c. Prepare Marvis’s statement of cash flows for the year ended December 31, 2018. Interpret your findings.

d. Use the information provided in the financial ratios and the cash flow statement to decide if you would support making the loan.

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292318738

10th Global Edition

Authors: Arthur Keown, John Martin, J. Petty