Using the information in Exercise 20-38 for Yum! Brands, determine the estimated valuation of the company at

Question:

Using the information in Exercise 20-38 for Yum! Brands, determine the estimated valuation of the company at the end of 2019 using each of the following three methods (round answers to the nearest whole dollar). Assume earnings and cash flows for the coming 10 years are equal to the earnings and cash flows in 2019. The appropriate free cash flow multiplier is 23.4.

a. Market capitalization.

b. Enterprise value.

c. Free cash flow multiple.

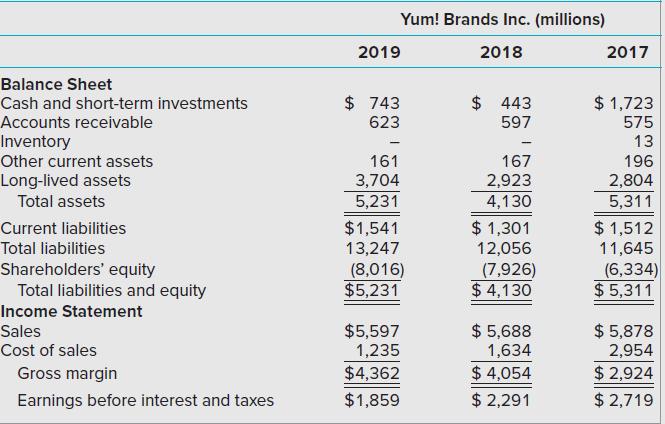

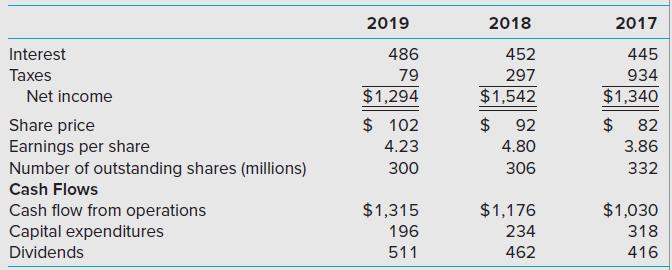

Exercise 20-38

Consider the following balance sheet and income statement for Yum! Brands Inc. (the company that operates Kentucky Fried Chicken and Pizza Hut), in condensed form, including some information from the cash flow statement:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: