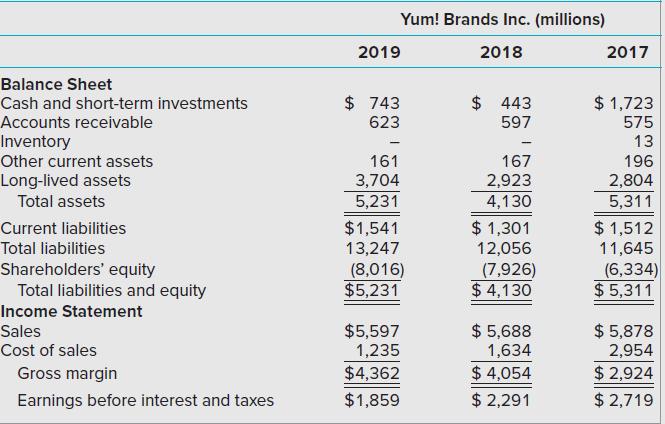

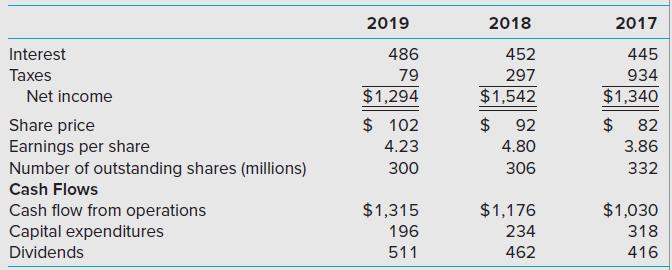

Consider the following balance sheet and income statement for Yum! Brands Inc. (the company that operates Kentucky

Question:

Consider the following balance sheet and income statement for Yum! Brands Inc. (the company that operates Kentucky Fried Chicken and Pizza Hut), in condensed form, including some information from the cash flow statement:

Required

1. Calculate the following ratios for Yum! Brands in 2019 and 2018. Round your calculations to 1 decimal place.

a. Gross margin percent.

b. Return on assets (ROA).

c. Return on equity (ROE).

2. What unique information is provided by each of these profitability metrics?

3. Yum! Brands had negative equity in each of the three years reflected in the table, due to a massive stock repurchase that was approved and executed during 2016 (financed largely with new debt). What information does the ROE measure provide when equity is negative?

Step by Step Answer: