Question: Using the information in Problem 9-46, complete the following: Data from Problem 9-46 Computer Graphics (CG) is a small manufacturer of electronic products for computers

Using the information in Problem 9-46, complete the following:

Data from Problem 9-46

Computer Graphics (CG) is a small manufacturer of electronic products for computers with graphics capabilities. The company has succeeded by being very innovative in product design. As a spin-off of a large electronics manufacturer (ElecTech), CG management has extensive experience in both marketing and manufacturing in the electronics industry. A long list of equity investors is betting that the firm will really take off because of the growth of specialized graphics software and the increased demand for computers with enhanced graphics capability. A number of market analysts say, however, that the market for the firm’s products is somewhat risky, as it is for many high-tech start-ups, because of the number of new competitors entering the market and CG’s unproven technology.

CG’s main product is a circuit board (CB3668) used in computers with enhanced graphics capabilities.

Prices vary depending on the terms of sale and the size of the purchase; the average price for the CB3668 is $100. If the firm is successful, it might be able to raise prices, but it also might have to reduce the price because of increased competition. The firm expects to sell 150,000 units in the coming year, and sales are expected to increase in the following years. The future for CG looks very bright indeed, but the company is new and has not developed a strong financial base. Cash flow management is a critical feature of the firm’s financial management, and top management must watch cash flow numbers closely.

At present, CG is manufacturing the CB3668 in a plant leased from ElecTech using some equipment purchased from ElecTech. CG manufactures about 70 percent of the parts in this circuit board. CG management is considering a significant reengineering project to significantly change the plant and manufacturing process. The project’s objective is to increase the number of purchased parts (to about 55%) and to reduce the complexity of the manufacturing process. This would also permit CG to remove some leased equipment and to sell some of the most expensive equipment in the plant.

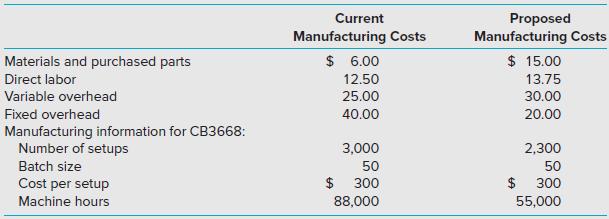

The per-unit manufacturing costs for 150,000 units of CB3668 follow:

Required

1. Compute the breakeven point in units for both the current and the proposed manufacturing plans, assuming that total setup costs vary with the number of batches and that the batch size is fixed (other than for the last batch, in most cases). Assume that setup costs are the only costs that vary with the number of batches.

2. As a check on your calculations in requirement 1, prepare a contribution income statement at the exact breakeven point for both the current plan and the proposed plan.

3. Compare your solution in requirement 2 to that for Problem 9-46 and interpret the difference.

Current Proposed Manufacturing Costs Manufacturing Costs Materials and purchased parts $ 6.00 $ 15.00 Direct labor 12.50 13.75 Variable overhead 25.00 30.00 Fixed overhead 40.00 20.00 Manufacturing information for CB3668: Number of setups 3,000 2,300 Batch size 50 50 Cost per setup $ 300 $ 300 Machine hours 88,000 55,000

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

1 Total fixed overhead costs including setup cost is equal to 6000000 ie 40 per unit 150000 units Setup costs are 300 per setup given Under the current production plan there are 3000 setups so total s... View full answer

Get step-by-step solutions from verified subject matter experts