Refer to Exercise 8.24. In exercise 8.24 Cedar Hill Manufacturing produces wooden outdoor furniture. Cedar Hill uses

Question:

In exercise 8.24

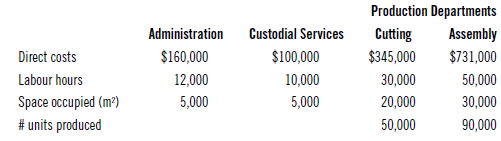

Cedar Hill Manufacturing produces wooden outdoor furniture. Cedar Hill uses the direct method to allocate service department costs to the production departments. There are two service departments: administration and custodial services, and two production departments: cutting and assembly. Administration costs are allocated based on labour hours, and custodial services costs are allocated based on space occupied.

REQUIRED

A. Using the direct method

1. Allocate the administration costs to the production departments.

2. Allocate the custodial services costs to the production departments.

B. Calculate the total costs (direct plus allocated) for each production department.

C. Calculate a cost per unit produced for cutting and assembly.

Assume instead that Cedar Hill Manufacturing uses the step-down method and allocates administration costs first followed by custodial services costs.

REQUIRED

A. Using the step-down method (round to 2 decimals):

1. Allocate the administration costs to the production departments.

2. Allocate the custodial services costs to the production departments.

B. Calculate the total costs (direct plus allocated) for each production department.

C. Calculate a cost per unit produced for cutting and assembly.

Step by Step Answer:

Cost Management Measuring, Monitoring and Motivating Performance

ISBN: 978-1119185697

3rd Canadian edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook